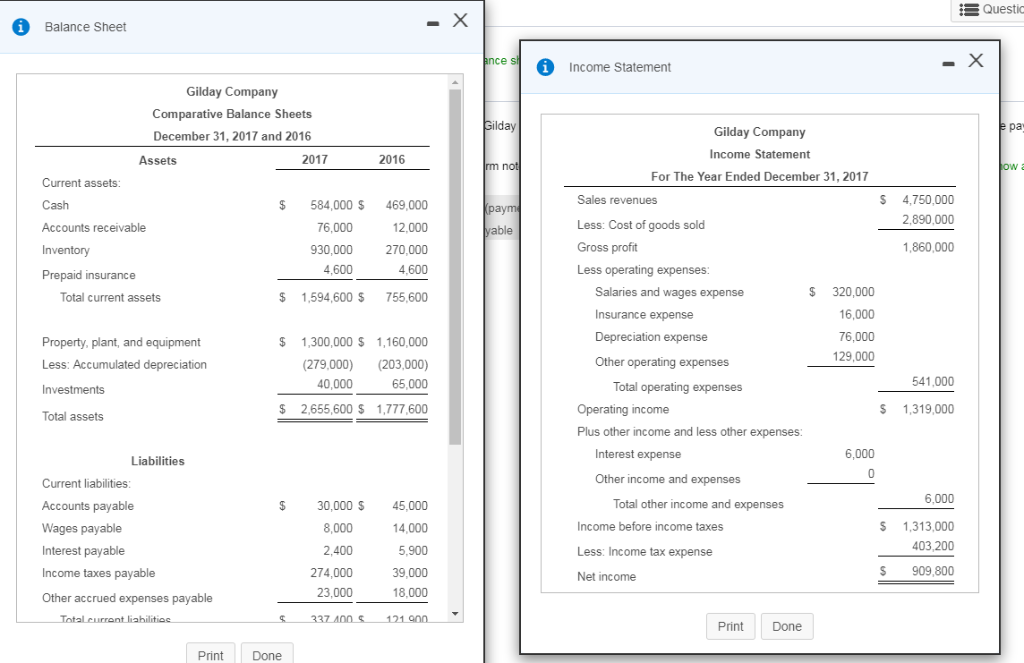

Accrued Expenses In Balance Sheet - You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.

You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.

You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.

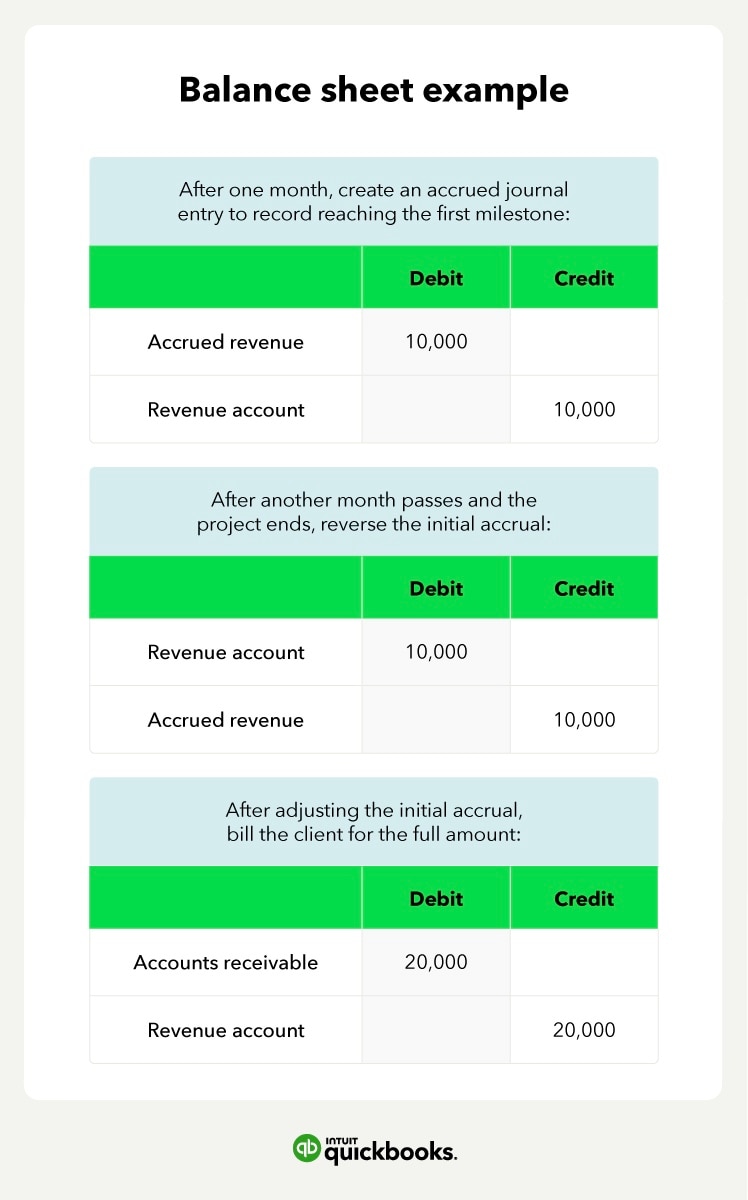

Is accrued receivable debit or credit? Leia aqui Is accrued receivable

You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets.

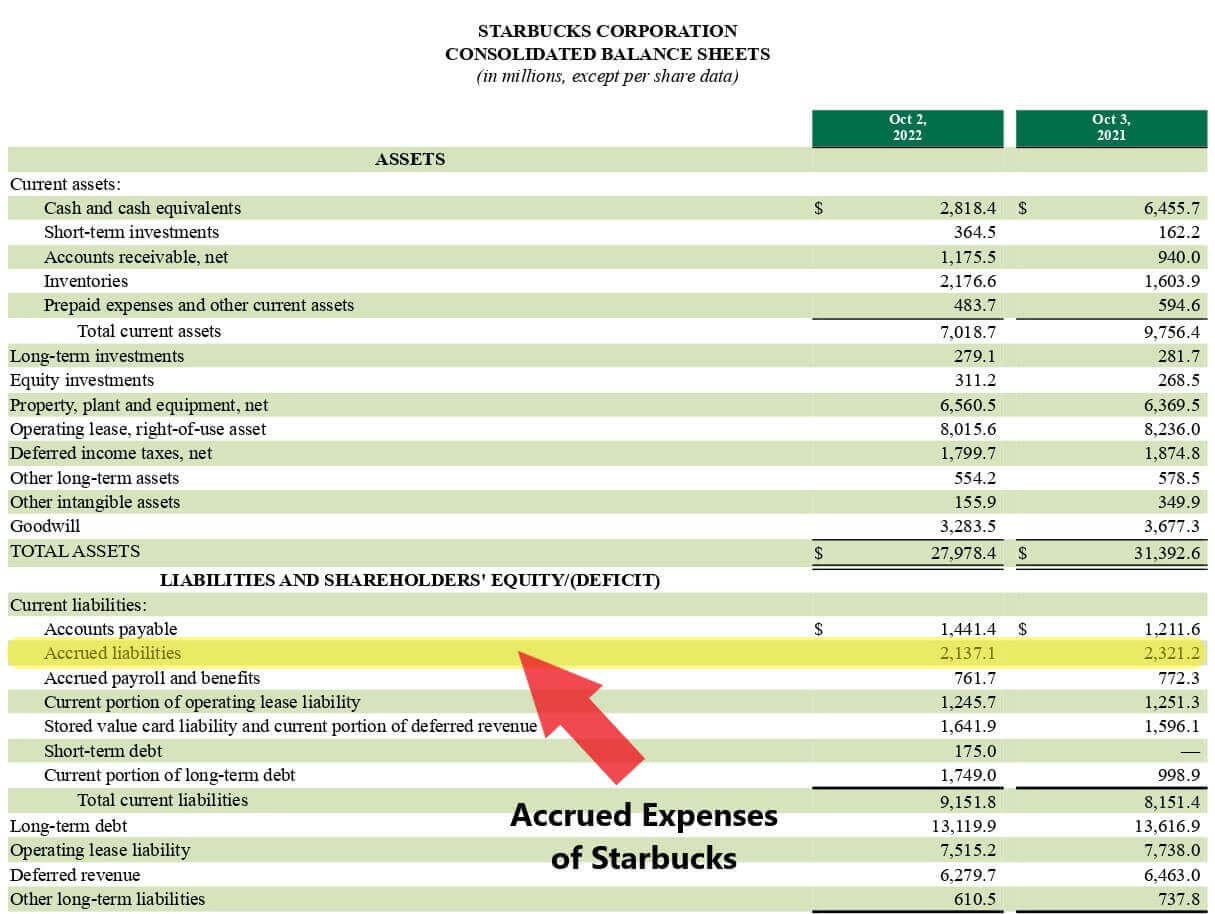

Accrued Liability

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably.

Accrued Expense Examples of Accrued Expenses

Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets.

Accrued Expense Definition And Accounting Process vrogue.co

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.

rebranding costs accounting treatment

You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets.

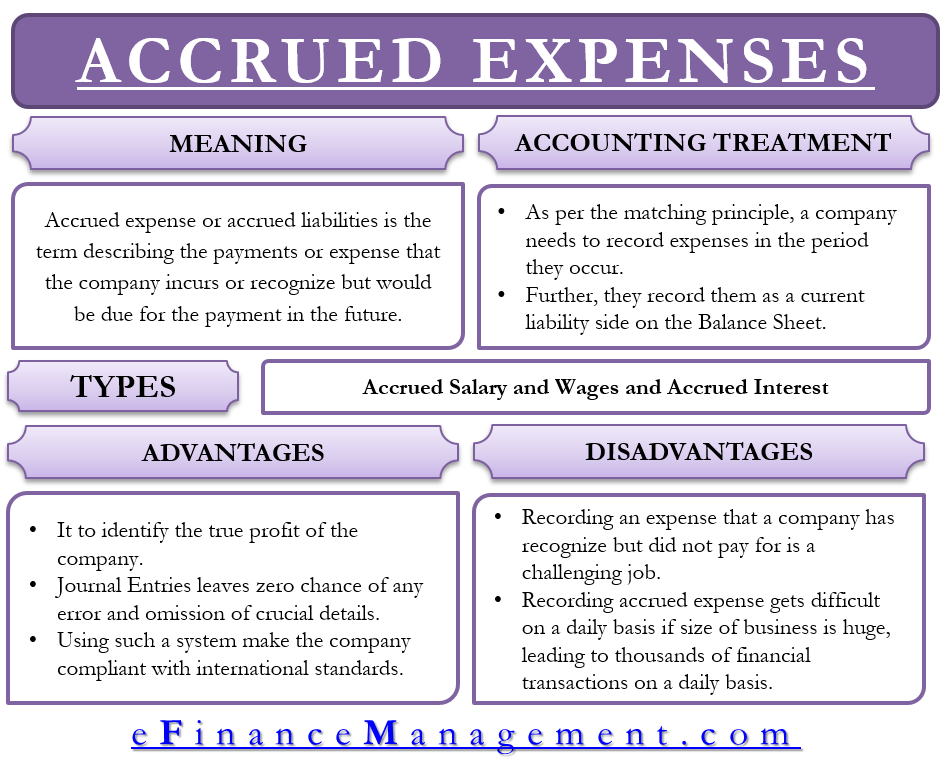

Accrued Expense Meaning, Accounting Treatment And More

You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.

Accrued Expense Examples of Accrued Expenses

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.

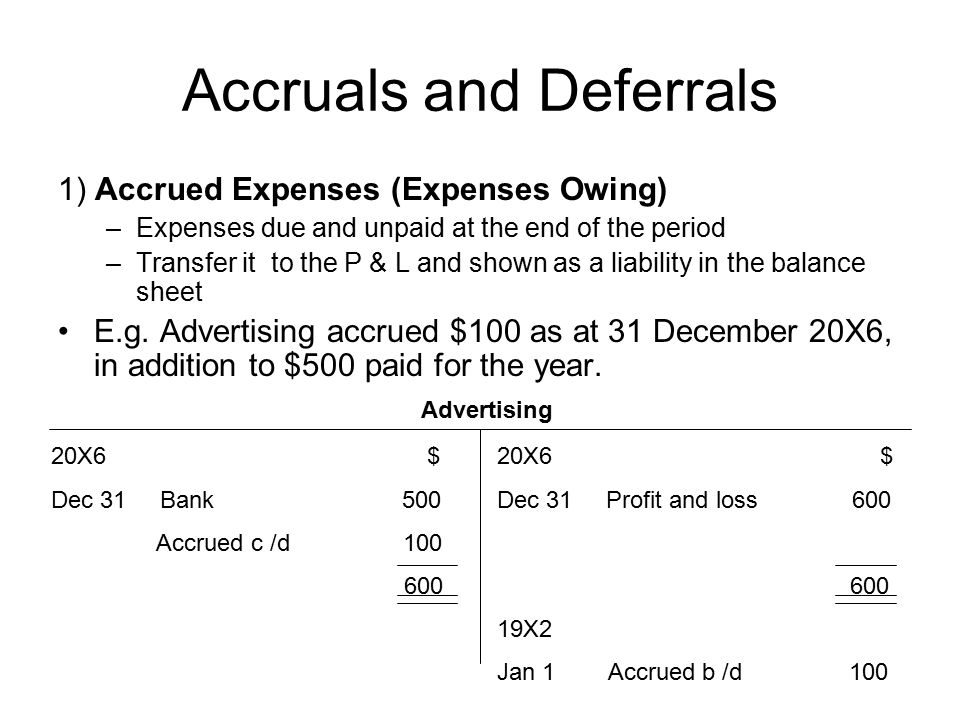

The accrual basis of accounting Business Accounting

Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets.

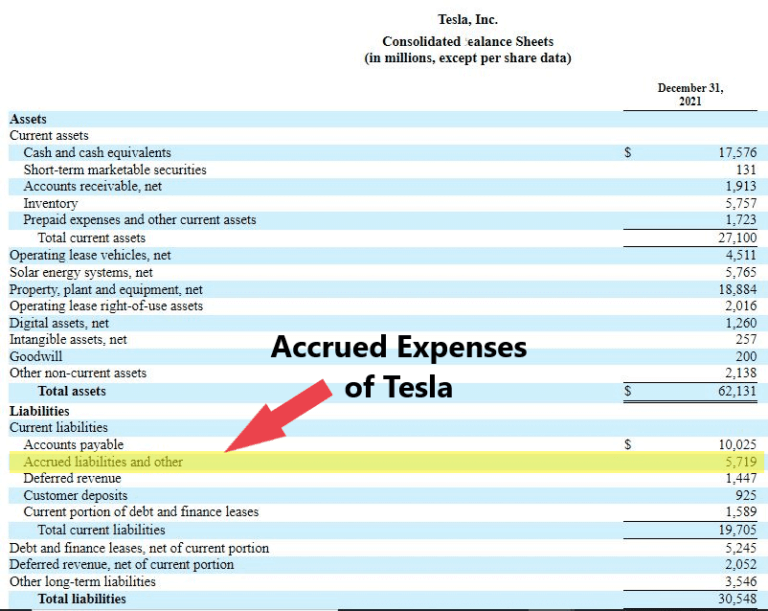

Accrued Expense ⋆ Accounting Services

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably.

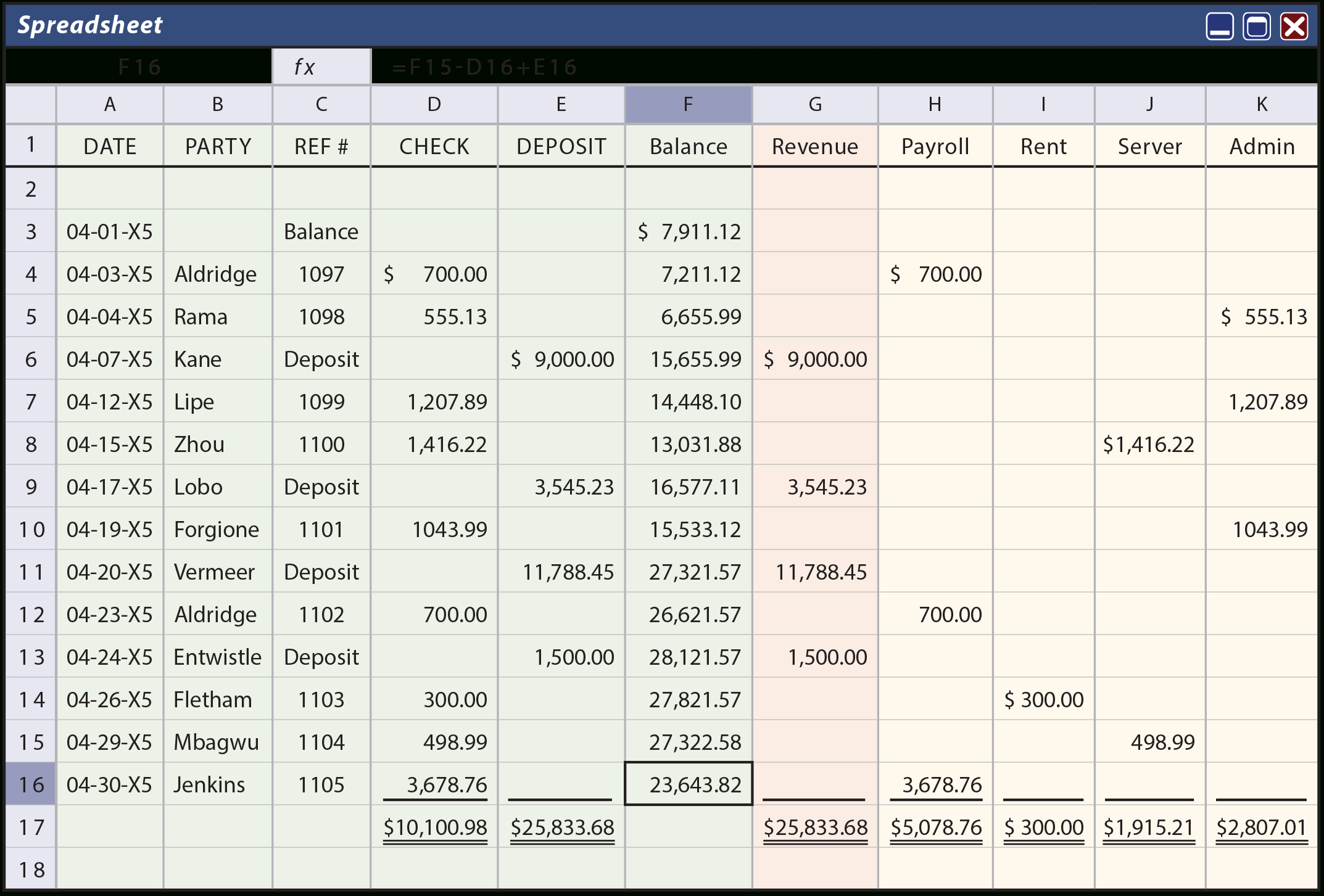

Expense Accrual Spreadsheet Template —

You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets.

You Record An Accrued Expense When You Have Incurred The Expense But Have Not Yet Recorded A Supplier Invoice (Probably.

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.