Advertising Expense On Balance Sheet - In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized within the same. At that time, the company has the obligation to pay the supplier, so they. Advertising costs are recorded as an expense in the income statement through a journal entry that debits the advertising. The expense is recorded when the supplier performs the service.

In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized within the same. At that time, the company has the obligation to pay the supplier, so they. Advertising costs are recorded as an expense in the income statement through a journal entry that debits the advertising. The expense is recorded when the supplier performs the service.

Advertising costs are recorded as an expense in the income statement through a journal entry that debits the advertising. The expense is recorded when the supplier performs the service. At that time, the company has the obligation to pay the supplier, so they. In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized within the same.

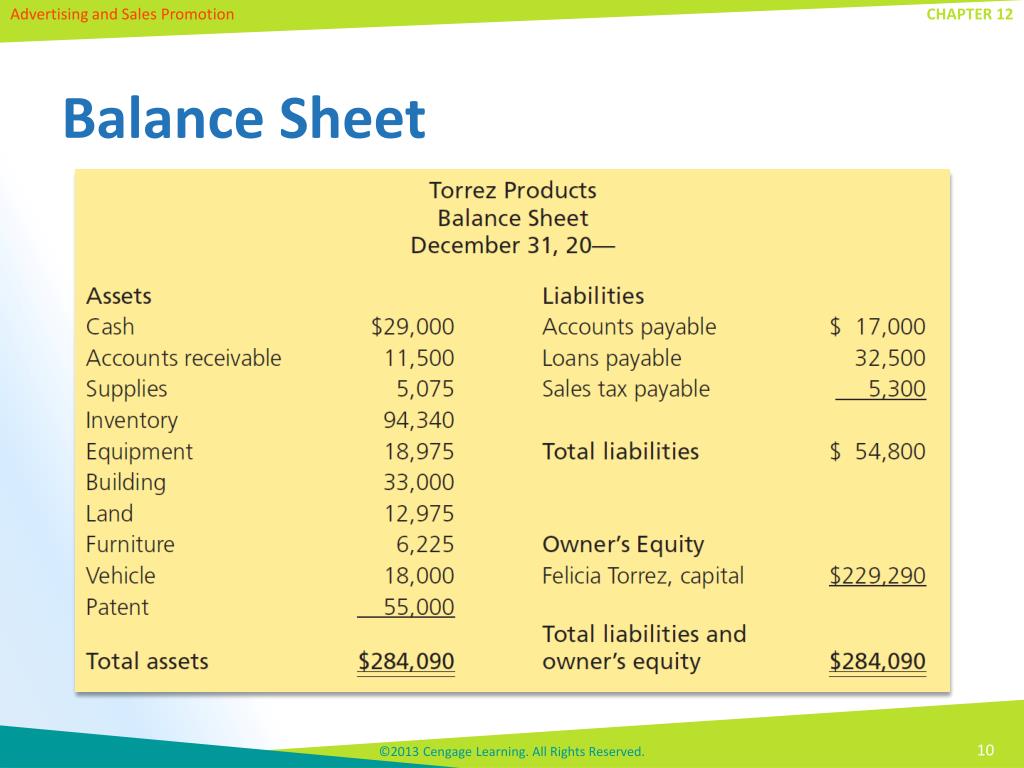

PPT The Economics of Advertising PowerPoint Presentation, free

In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized within the same. The expense is recorded when the supplier performs the service. At that time, the company has the obligation to pay the supplier, so they. Advertising costs are recorded as an expense in the income statement through a journal entry that.

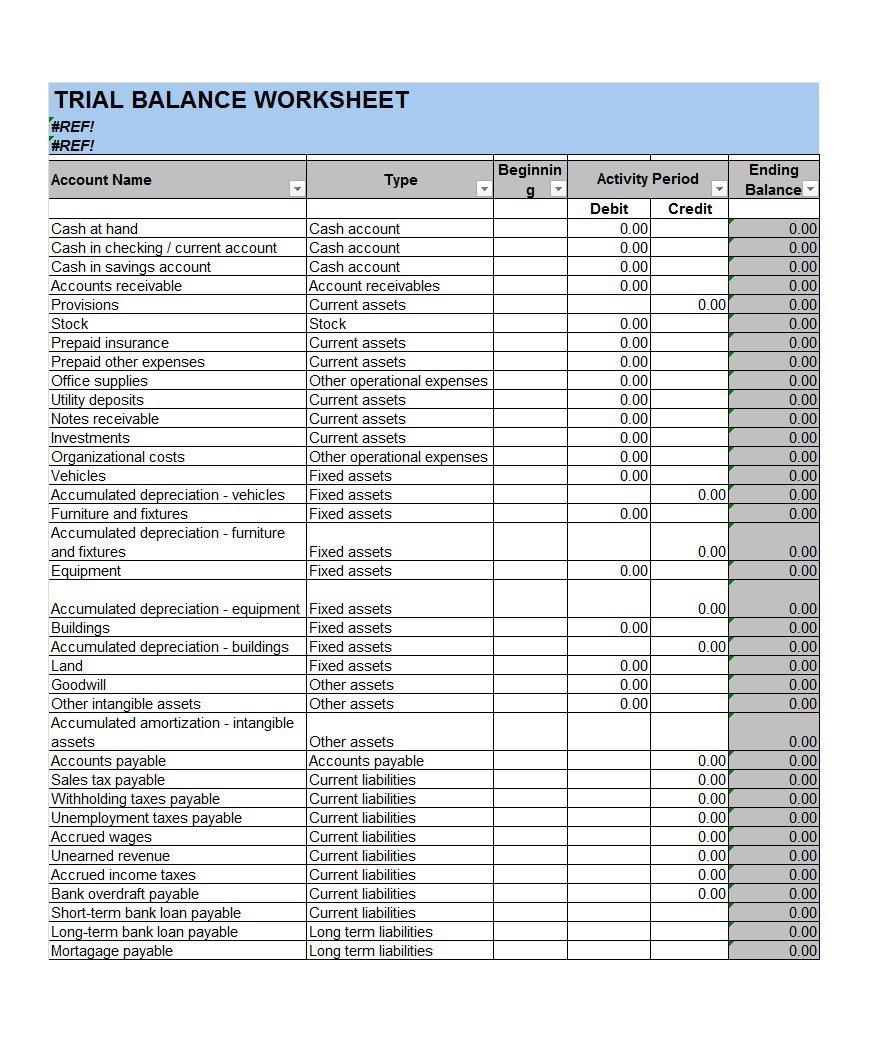

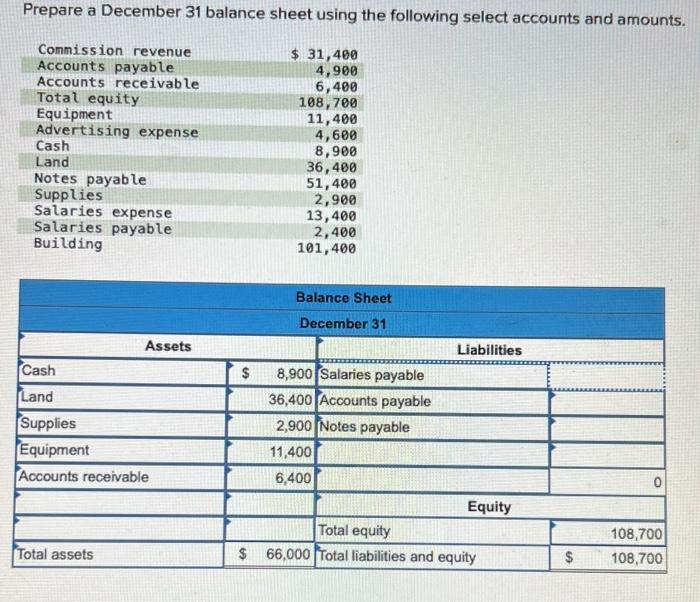

Account Balance Spreadsheet Template with 38 Free Balance Sheet

The expense is recorded when the supplier performs the service. At that time, the company has the obligation to pay the supplier, so they. Advertising costs are recorded as an expense in the income statement through a journal entry that debits the advertising. In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized.

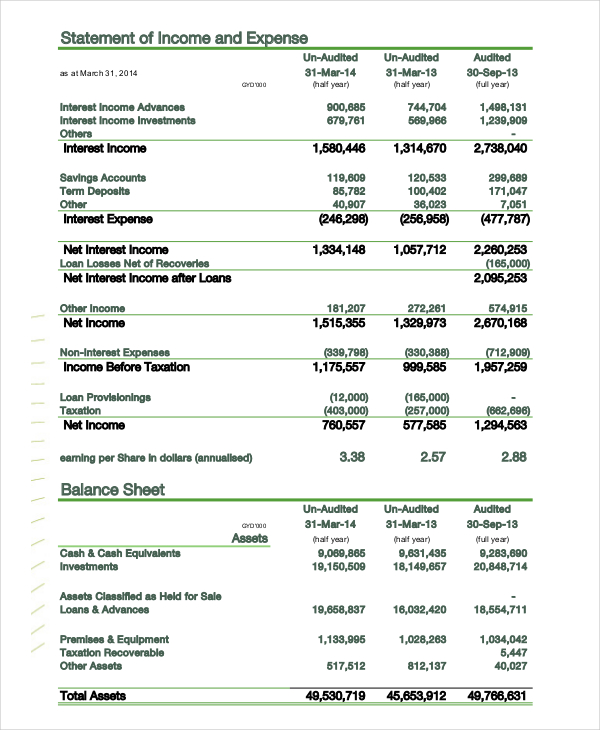

Asset Light Balance Sheet at Catherine Lackey blog

The expense is recorded when the supplier performs the service. At that time, the company has the obligation to pay the supplier, so they. In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized within the same. Advertising costs are recorded as an expense in the income statement through a journal entry that.

[Solved] We are to fill out the balance sheet using the information on

Advertising costs are recorded as an expense in the income statement through a journal entry that debits the advertising. At that time, the company has the obligation to pay the supplier, so they. The expense is recorded when the supplier performs the service. In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized.

21+ Free Expense Sheet Templates

In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized within the same. Advertising costs are recorded as an expense in the income statement through a journal entry that debits the advertising. At that time, the company has the obligation to pay the supplier, so they. The expense is recorded when the supplier.

Solved Prepare a December 31 balance sheet using the

At that time, the company has the obligation to pay the supplier, so they. Advertising costs are recorded as an expense in the income statement through a journal entry that debits the advertising. The expense is recorded when the supplier performs the service. In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized.

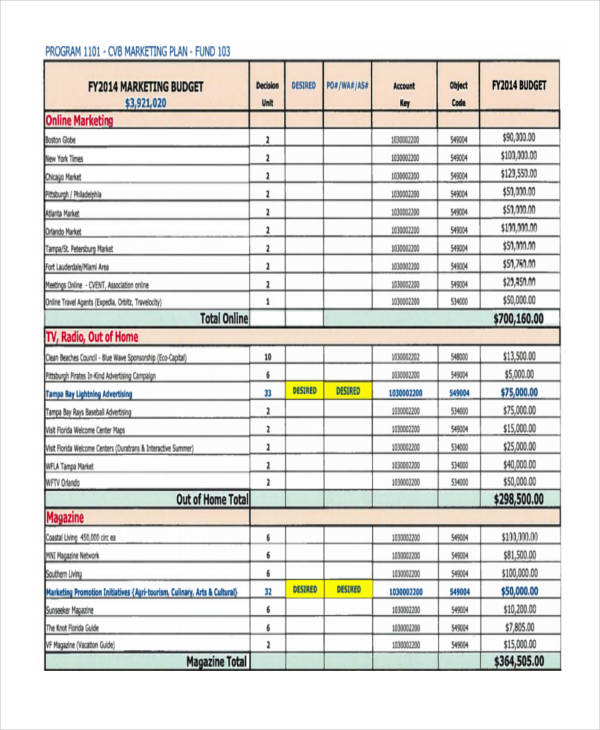

9+ Advertising Budget Templates Free Sample, Example, Format Download

At that time, the company has the obligation to pay the supplier, so they. In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized within the same. The expense is recorded when the supplier performs the service. Advertising costs are recorded as an expense in the income statement through a journal entry that.

[Template] How to Create a Marketing Budget Sponge

Advertising costs are recorded as an expense in the income statement through a journal entry that debits the advertising. The expense is recorded when the supplier performs the service. At that time, the company has the obligation to pay the supplier, so they. In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized.

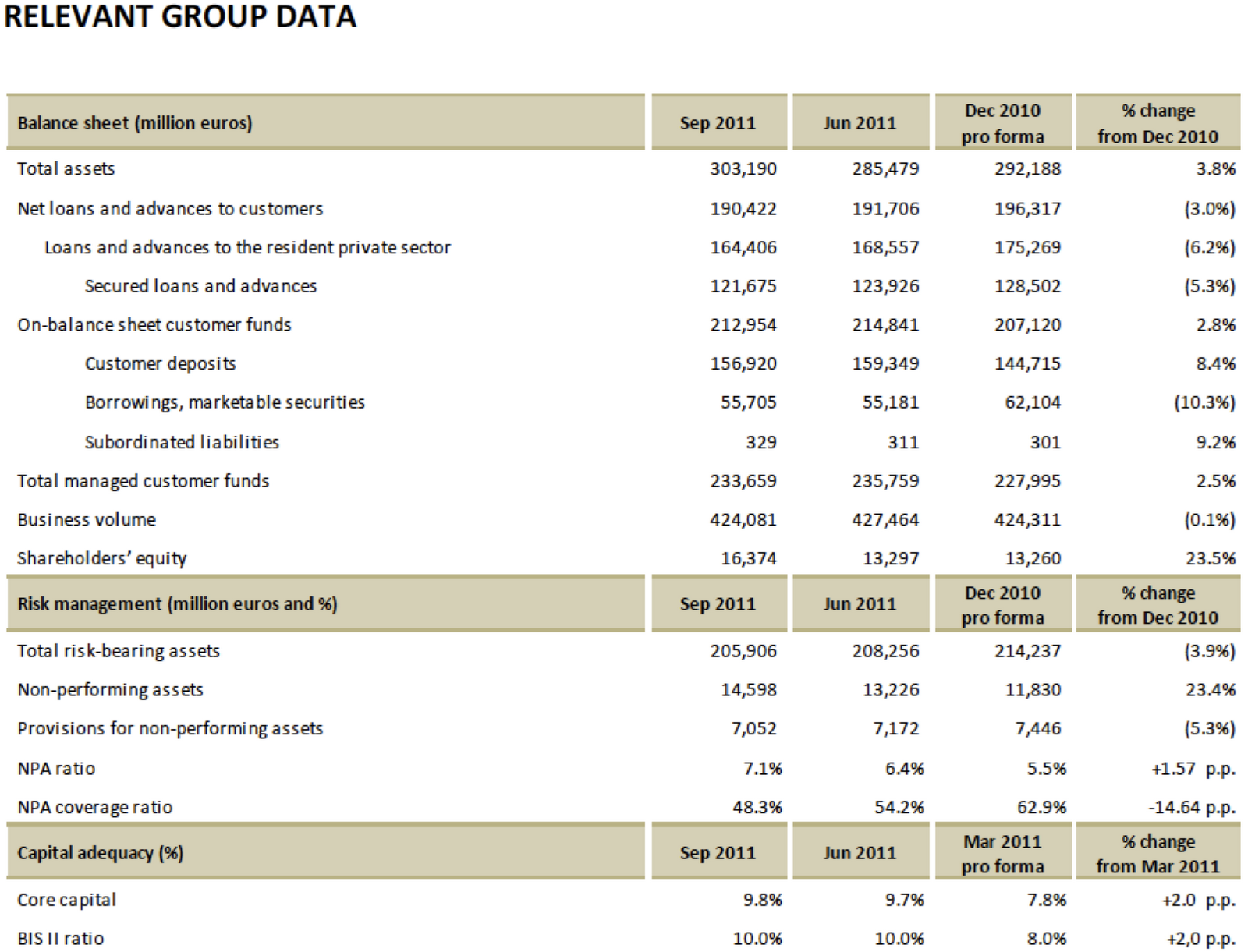

[Solved] statement and balance sheet excerp SolutionInn

At that time, the company has the obligation to pay the supplier, so they. Advertising costs are recorded as an expense in the income statement through a journal entry that debits the advertising. In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized within the same. The expense is recorded when the supplier.

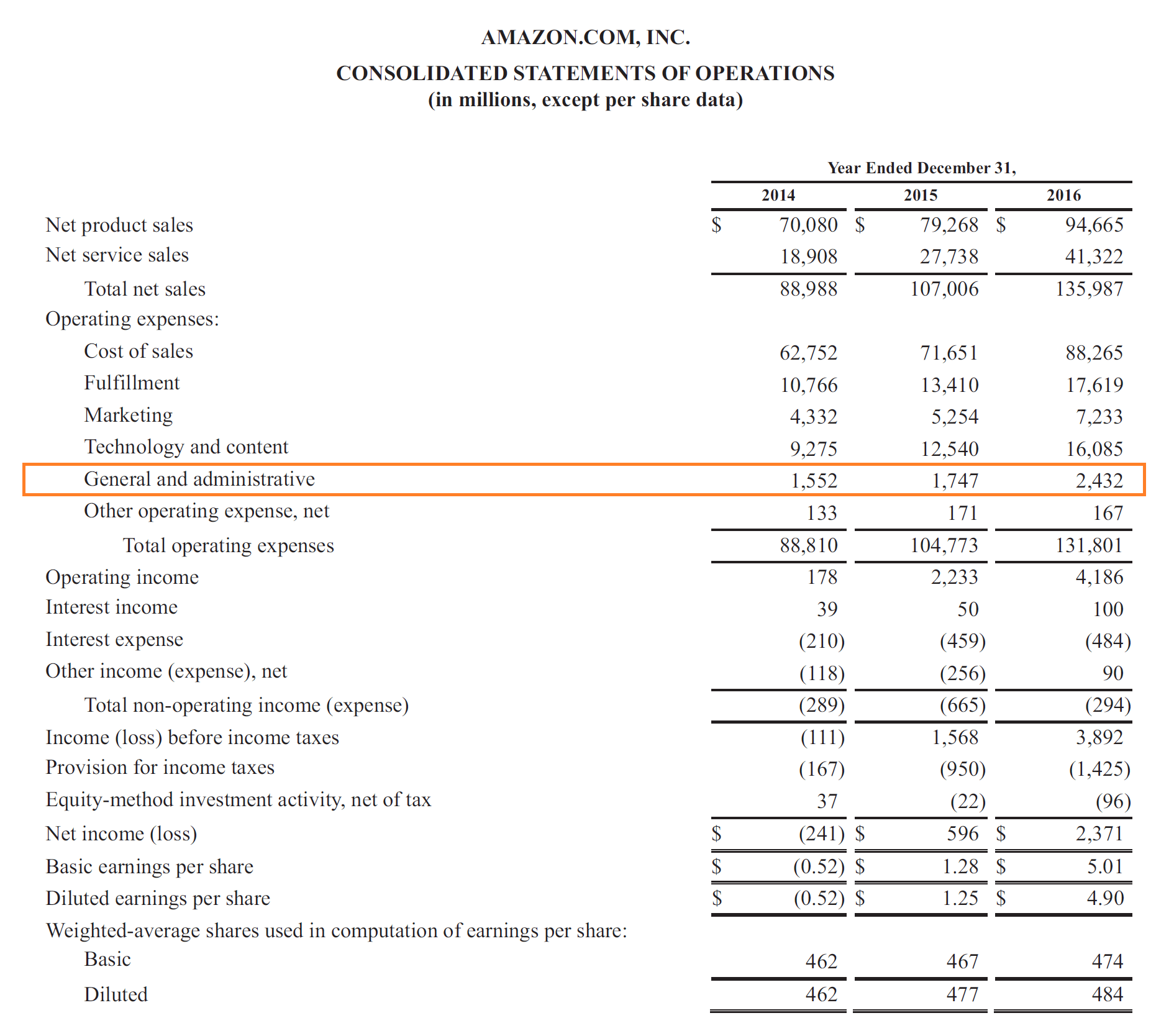

SG&A Expense (Selling, General & Administrative) Guide, Examples

At that time, the company has the obligation to pay the supplier, so they. In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized within the same. The expense is recorded when the supplier performs the service. Advertising costs are recorded as an expense in the income statement through a journal entry that.

Advertising Costs Are Recorded As An Expense In The Income Statement Through A Journal Entry That Debits The Advertising.

In most cases, advertising is classified as an expense because its benefits are uncertain and typically realized within the same. At that time, the company has the obligation to pay the supplier, so they. The expense is recorded when the supplier performs the service.

![[Template] How to Create a Marketing Budget Sponge](https://sponge.io/wp-content/uploads/2020/03/AnnualMarketingBudget-07.jpg)

![[Solved] statement and balance sheet excerp SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1543/4/8/9/0145bffc5f6069c91543471535041.jpg)