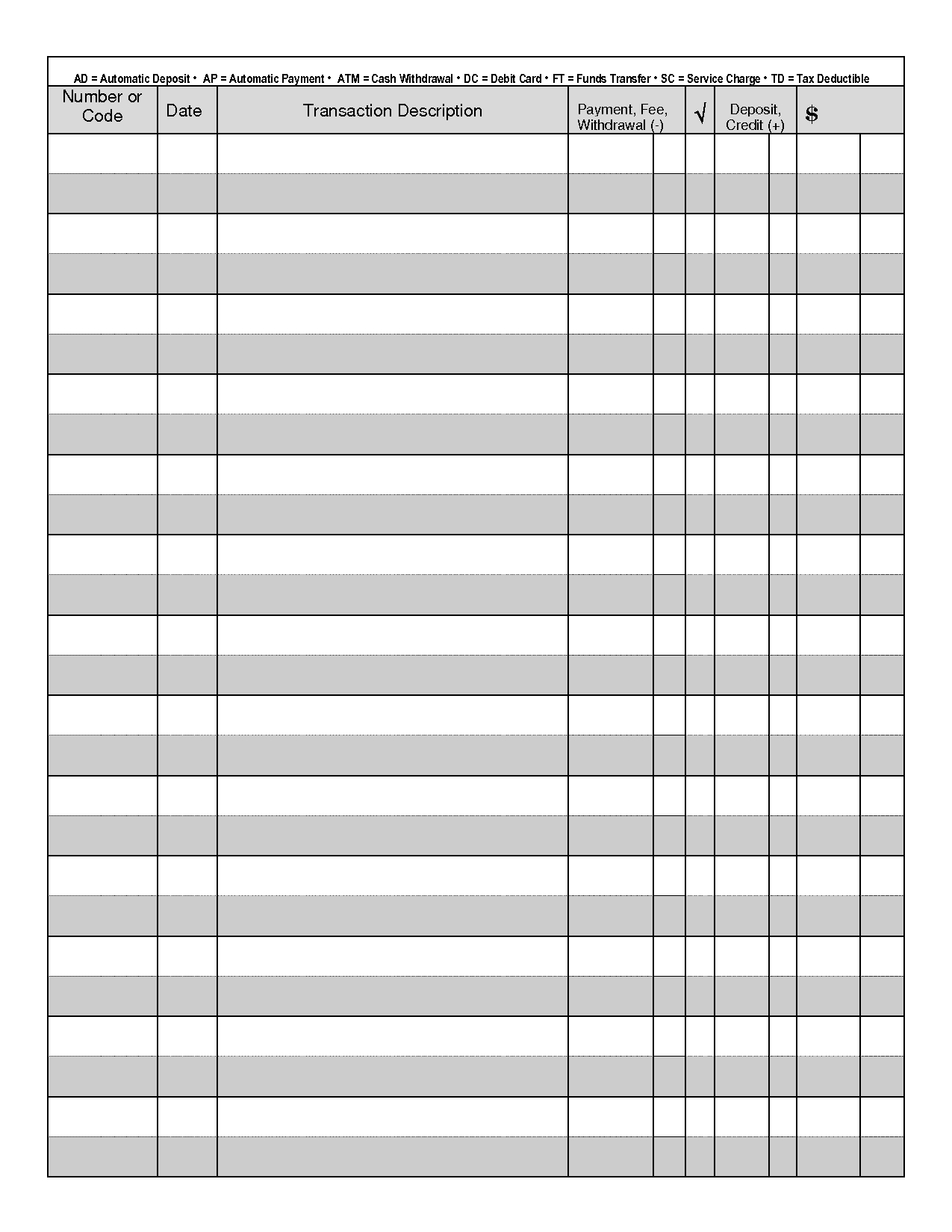

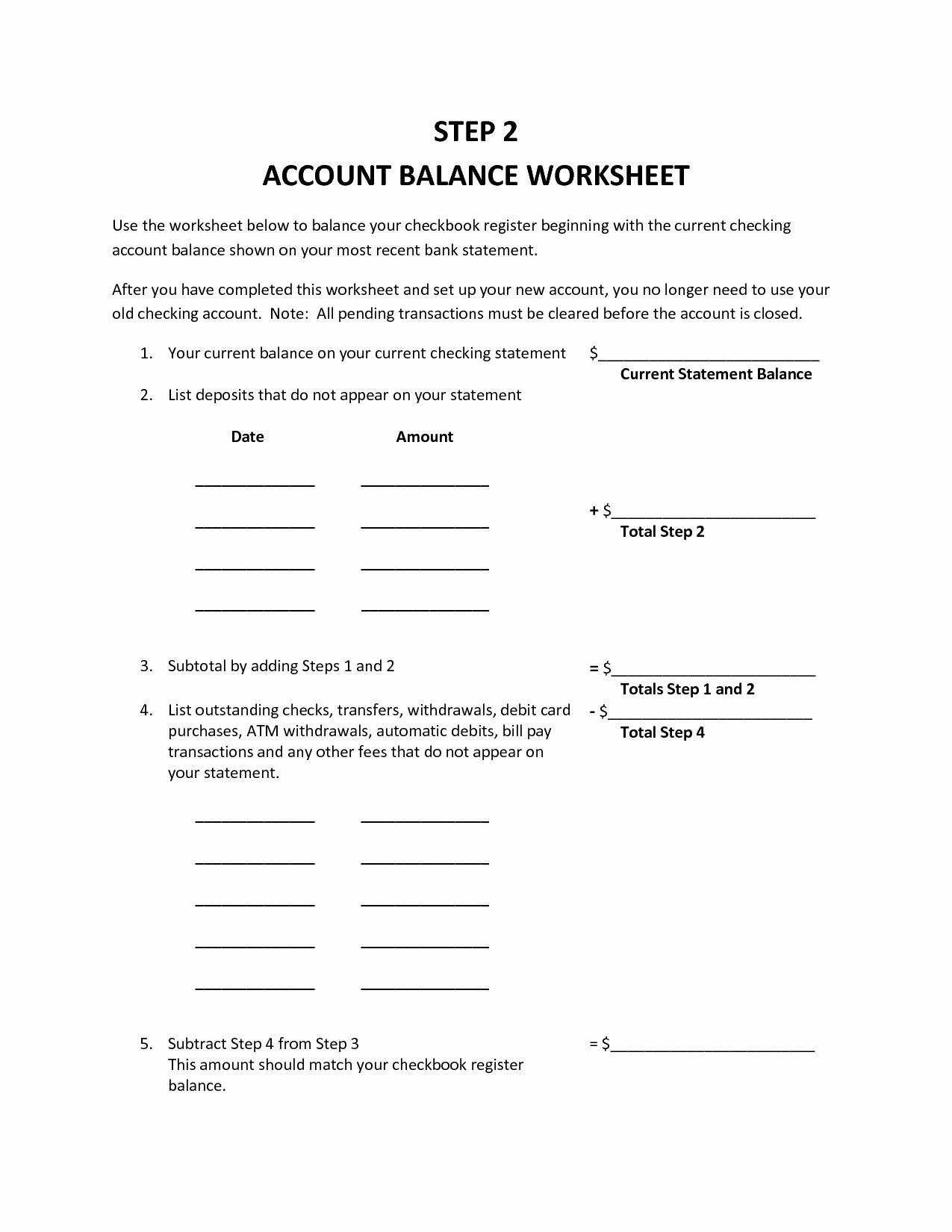

Balance Checkbook Sheet - There are 13 different checkbook registers to choose from. Use this worksheet to assist you in balancing your checkbook. Refer to your checkbook register and account statement to complete the steps. In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits, interest or dividends, from both. You can choose from vertical or horizontal balance sheets and color or black.

Refer to your checkbook register and account statement to complete the steps. You can choose from vertical or horizontal balance sheets and color or black. In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits, interest or dividends, from both. There are 13 different checkbook registers to choose from. Use this worksheet to assist you in balancing your checkbook.

In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits, interest or dividends, from both. Refer to your checkbook register and account statement to complete the steps. You can choose from vertical or horizontal balance sheets and color or black. There are 13 different checkbook registers to choose from. Use this worksheet to assist you in balancing your checkbook.

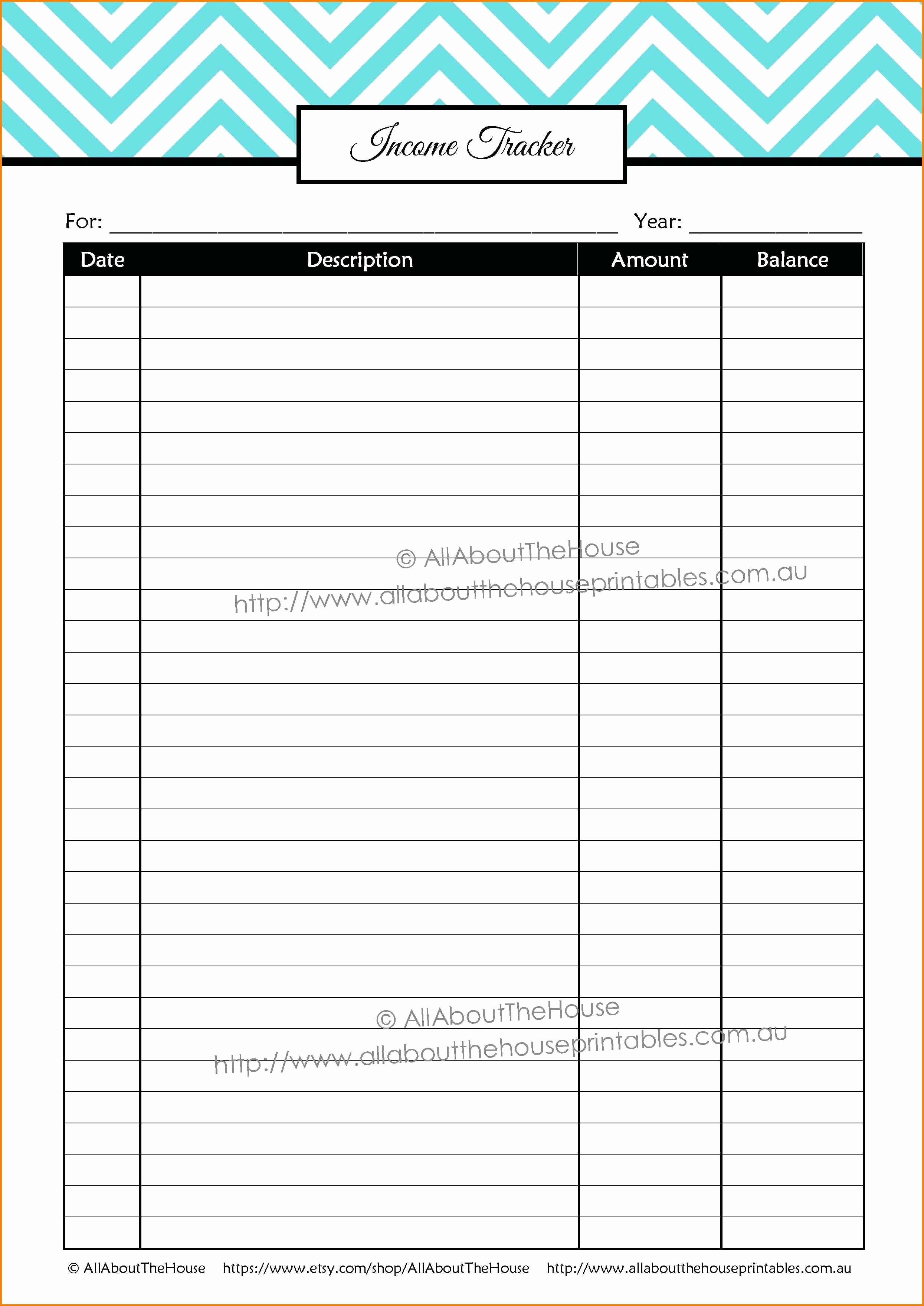

Checkbook Balance Sheets Printable

In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits, interest or dividends, from both. You can choose from vertical or horizontal balance sheets and color or black. Refer to your checkbook register and account statement to complete the steps. Use this worksheet to assist you in balancing your checkbook. There.

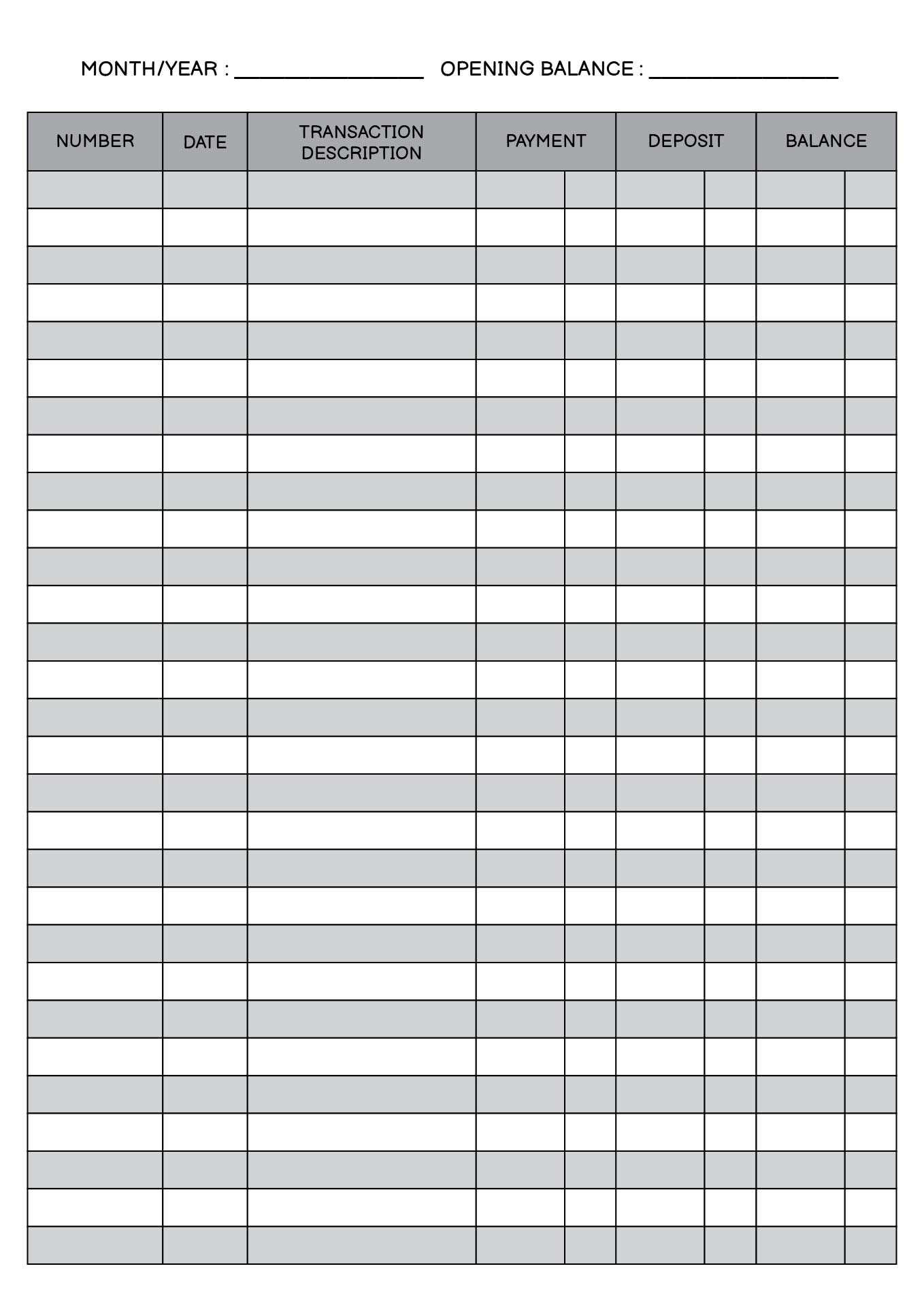

Checkbook Balance Sheet Excel

Use this worksheet to assist you in balancing your checkbook. Refer to your checkbook register and account statement to complete the steps. There are 13 different checkbook registers to choose from. You can choose from vertical or horizontal balance sheets and color or black. In order to balance your checkbook register to your bank statement, first add any credits (+).

Free Balancing Checkbook Worksheets

There are 13 different checkbook registers to choose from. Use this worksheet to assist you in balancing your checkbook. In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits, interest or dividends, from both. Refer to your checkbook register and account statement to complete the steps. You can choose from vertical.

Free Printable Checkbook Balance Sheet

In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits, interest or dividends, from both. There are 13 different checkbook registers to choose from. Refer to your checkbook register and account statement to complete the steps. Use this worksheet to assist you in balancing your checkbook. You can choose from vertical.

Checkbook Balance Sheet Printable

You can choose from vertical or horizontal balance sheets and color or black. Use this worksheet to assist you in balancing your checkbook. There are 13 different checkbook registers to choose from. In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits, interest or dividends, from both. Refer to your checkbook.

12 Balance Checkbook Worksheet Practice Free PDF at

Refer to your checkbook register and account statement to complete the steps. There are 13 different checkbook registers to choose from. Use this worksheet to assist you in balancing your checkbook. You can choose from vertical or horizontal balance sheets and color or black. In order to balance your checkbook register to your bank statement, first add any credits (+).

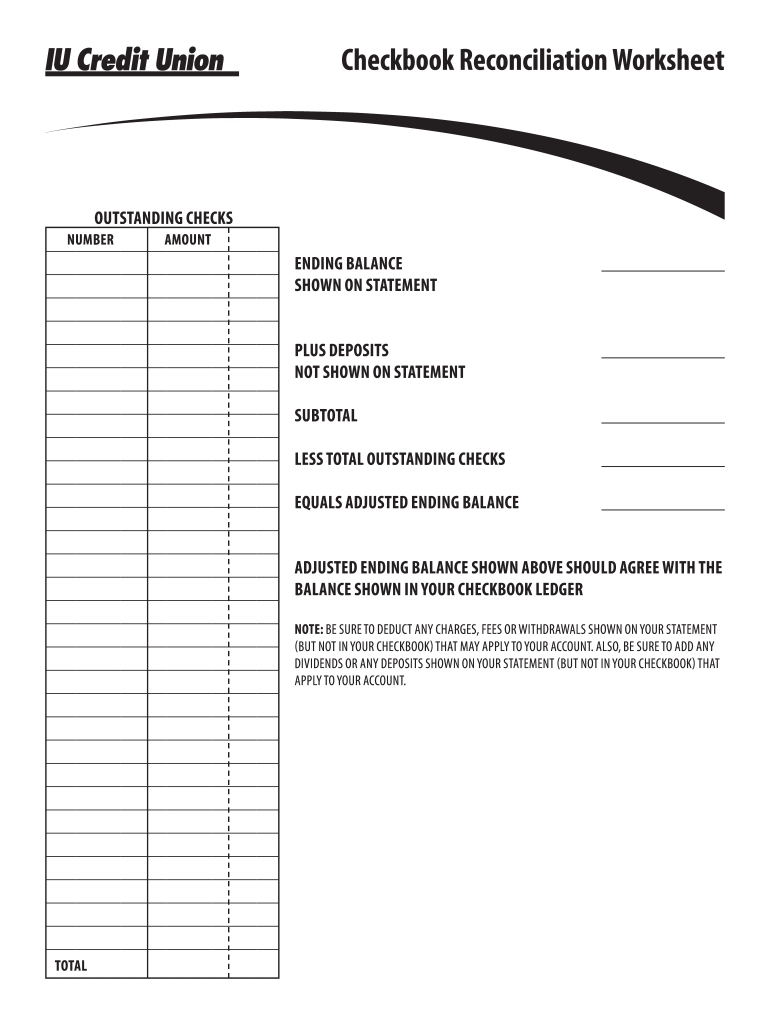

Checkbook Balance Sheet Edit & Share airSlate SignNow

Use this worksheet to assist you in balancing your checkbook. In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits, interest or dividends, from both. Refer to your checkbook register and account statement to complete the steps. There are 13 different checkbook registers to choose from. You can choose from vertical.

50 Balancing A Checkbook Worksheet

In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits, interest or dividends, from both. There are 13 different checkbook registers to choose from. Use this worksheet to assist you in balancing your checkbook. Refer to your checkbook register and account statement to complete the steps. You can choose from vertical.

Balancing A Checkbook Practice Worksheets

You can choose from vertical or horizontal balance sheets and color or black. Use this worksheet to assist you in balancing your checkbook. There are 13 different checkbook registers to choose from. In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits, interest or dividends, from both. Refer to your checkbook.

How To Balance Your Checkbook Worksheet

There are 13 different checkbook registers to choose from. Refer to your checkbook register and account statement to complete the steps. Use this worksheet to assist you in balancing your checkbook. You can choose from vertical or horizontal balance sheets and color or black. In order to balance your checkbook register to your bank statement, first add any credits (+).

There Are 13 Different Checkbook Registers To Choose From.

In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits, interest or dividends, from both. You can choose from vertical or horizontal balance sheets and color or black. Use this worksheet to assist you in balancing your checkbook. Refer to your checkbook register and account statement to complete the steps.