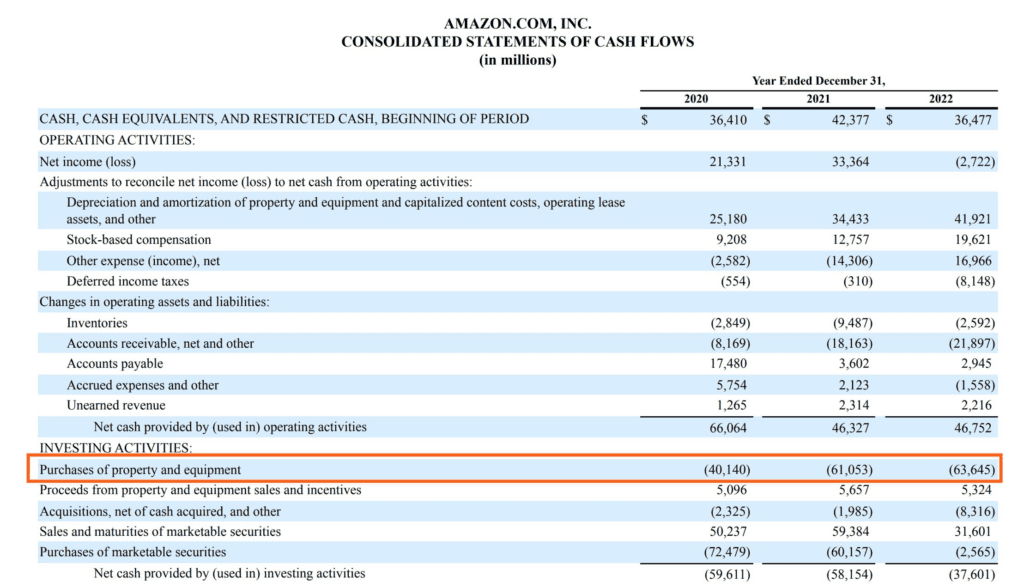

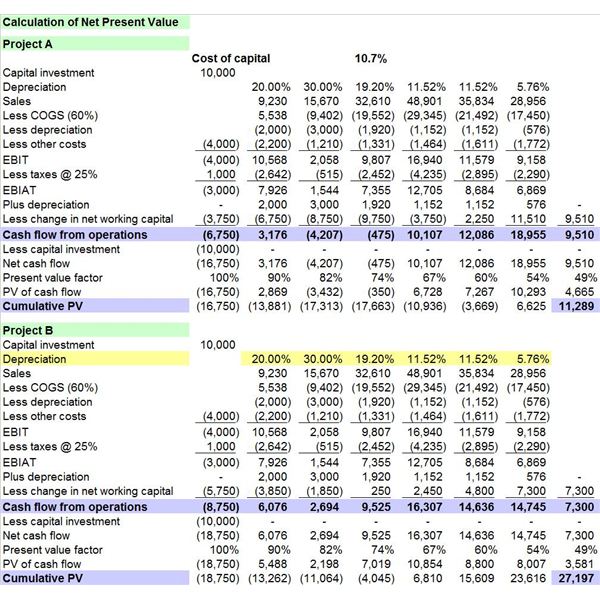

Capital Expenditures On Balance Sheet - This money is spent either to replace pp&e that has used up. When it comes to recording capital expenditures in financial statements, the process begins with identifying the expenditure and determining its eligibility for capitalization. It is shown in the balance sheet. Capex flows from the cash flow statement to the balance sheet. Capital expenditure is added to the cost of fixed assets; When analyzing the financial statements of a third party, it may be necessary to calculate its capital expenditures, using a capital expenditure formula. Capital expenditure is the total amount that a company spends to buy & upgrade its fixed assets like pp&e (property, plant, equipment), technology, & vehicles, etc. While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and recorded as assets on the company’s balance. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capital expenditure (capex) is the money a company spends on fixed assets, which fall under property, plant and equipment (pp&e).

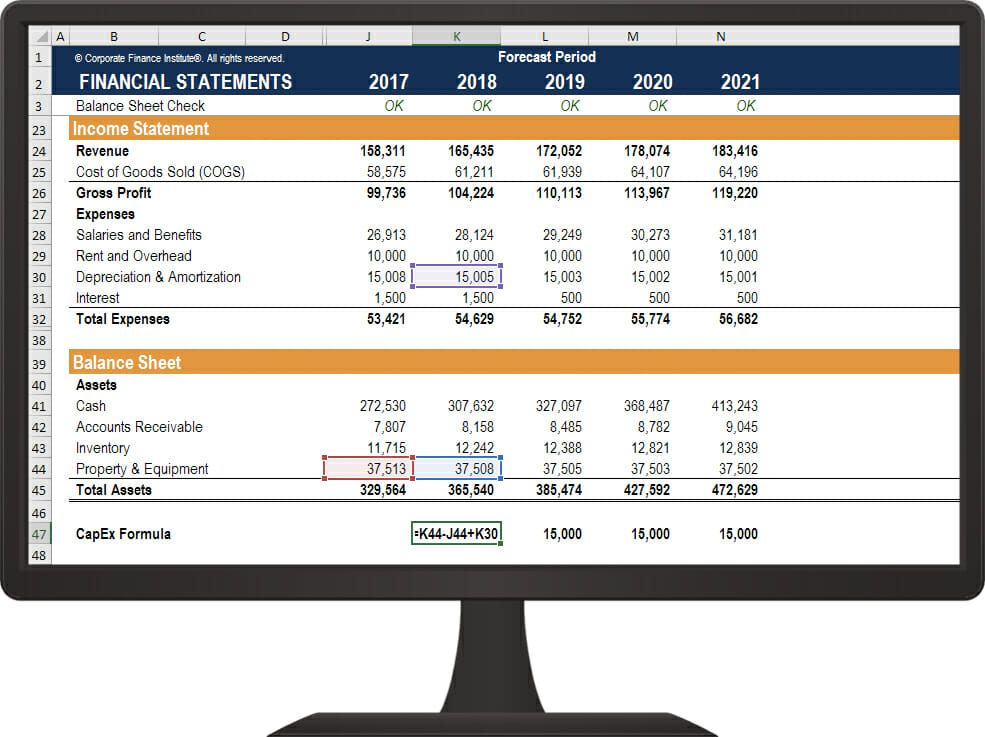

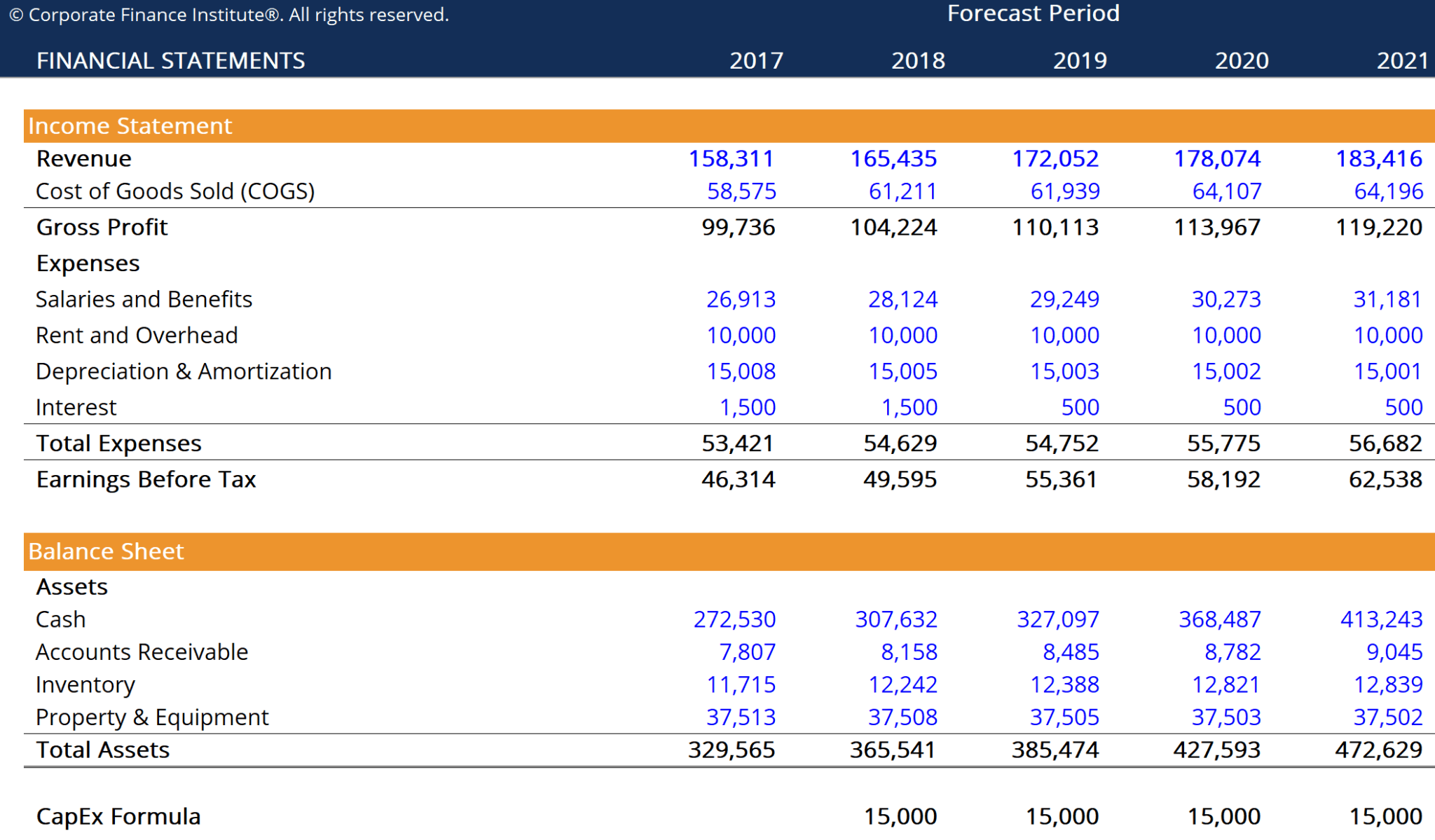

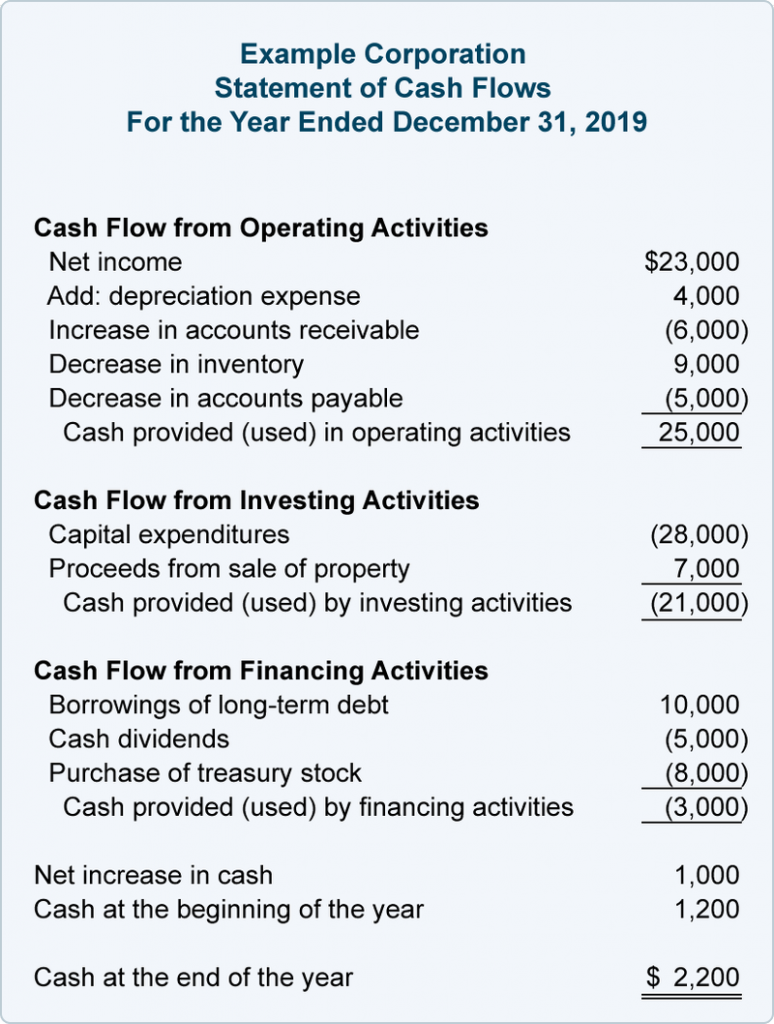

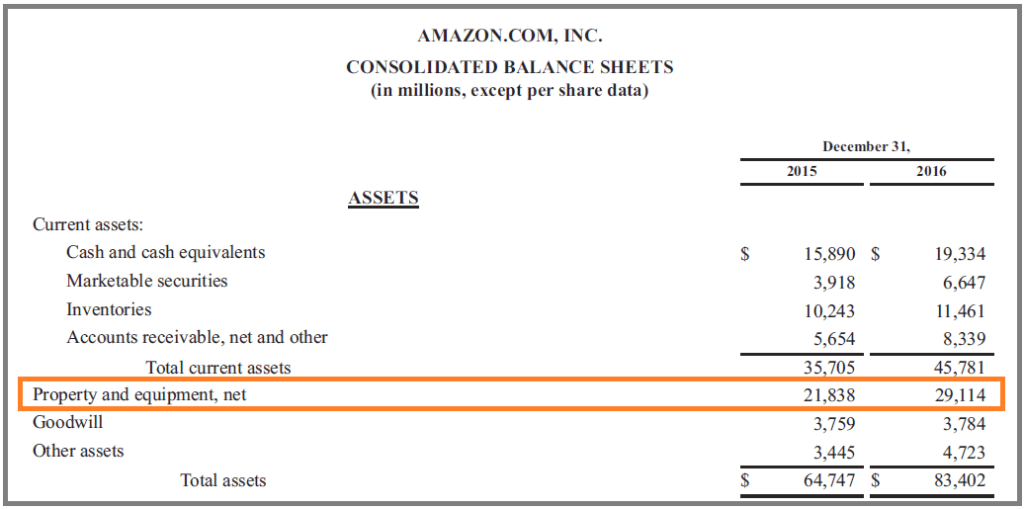

It is shown in the balance sheet. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via. This money is spent either to replace pp&e that has used up. While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and recorded as assets on the company’s balance. Capital expenditure is the total amount that a company spends to buy & upgrade its fixed assets like pp&e (property, plant, equipment), technology, & vehicles, etc. The formula of capex is the. Capex flows from the cash flow statement to the balance sheet. When analyzing the financial statements of a third party, it may be necessary to calculate its capital expenditures, using a capital expenditure formula. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the.

I.e., it is debited to the relevant fixed asset account. The formula of capex is the. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. Capex on the balance sheet. It is shown in the balance sheet. Capex flows from the cash flow statement to the balance sheet. Capital expenditure is added to the cost of fixed assets; Capital expenditure (capex) is the money a company spends on fixed assets, which fall under property, plant and equipment (pp&e). Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via. While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and recorded as assets on the company’s balance.

How to Calculate CapEx Formula

Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. This money is spent either to replace pp&e that has used up. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and.

Capital Expenditures Financial Modeling Institute

Capex flows from the cash flow statement to the balance sheet. It is shown in the balance sheet. When it comes to recording capital expenditures in financial statements, the process begins with identifying the expenditure and determining its eligibility for capitalization. Capital expenditure is the total amount that a company spends to buy & upgrade its fixed assets like pp&e.

CapEx (Capital Expenditure) Definition, Formula, and Examples

Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via. While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and.

CapEx Formula Template Download Free Excel Template

I.e., it is debited to the relevant fixed asset account. The formula of capex is the. Capital expenditure (capex) is the money a company spends on fixed assets, which fall under property, plant and equipment (pp&e). Capex on the balance sheet. It is shown in the balance sheet.

CAPEX (Capital Expenditure) Explained with Examples

The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditure is the total amount that a.

Capital Expenditure (CAPEX) Definition, Example, Formula

While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and recorded as assets on the company’s balance. This money is spent either to replace pp&e that has used up. The formula of capex is the. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on.

Capexbudgettemplateexcel

I.e., it is debited to the relevant fixed asset account. Capital expenditure is the total amount that a company spends to buy & upgrade its fixed assets like pp&e (property, plant, equipment), technology, & vehicles, etc. It is shown in the balance sheet. Capex on the balance sheet. Capital expenditure (capex) is the money a company spends on fixed assets,.

Como Calcular O Capex Design Talk

When it comes to recording capital expenditures in financial statements, the process begins with identifying the expenditure and determining its eligibility for capitalization. This money is spent either to replace pp&e that has used up. Capital expenditure is the total amount that a company spends to buy & upgrade its fixed assets like pp&e (property, plant, equipment), technology, & vehicles,.

What is capex and how do you calculate it?

The formula of capex is the. Capex flows from the cash flow statement to the balance sheet. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. Capital expenditure is added to the cost of fixed assets; Capital expenditure (capex) is.

Capital Expenditure (CAPEX) Definition, Example, Formula

Capital expenditure (capex) is the money a company spends on fixed assets, which fall under property, plant and equipment (pp&e). I.e., it is debited to the relevant fixed asset account. While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and recorded as assets on the company’s balance. Capex on the balance sheet..

I.e., It Is Debited To The Relevant Fixed Asset Account.

Capital expenditure is added to the cost of fixed assets; Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capital expenditure (capex) is the money a company spends on fixed assets, which fall under property, plant and equipment (pp&e).

When Analyzing The Financial Statements Of A Third Party, It May Be Necessary To Calculate Its Capital Expenditures, Using A Capital Expenditure Formula.

The formula of capex is the. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. It is shown in the balance sheet. Capex on the balance sheet.

This Money Is Spent Either To Replace Pp&E That Has Used Up.

Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via. Capex flows from the cash flow statement to the balance sheet. When it comes to recording capital expenditures in financial statements, the process begins with identifying the expenditure and determining its eligibility for capitalization. Capital expenditure is the total amount that a company spends to buy & upgrade its fixed assets like pp&e (property, plant, equipment), technology, & vehicles, etc.