Clearing Accounts On Balance Sheet - A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately. Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management.

Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management.

A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately. Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management.

Payroll Accounting Chapter 11 Payroll data is used

Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management. A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately.

Clearing Account & Reconciling Payments Help Centre

Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management. A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately. Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets.

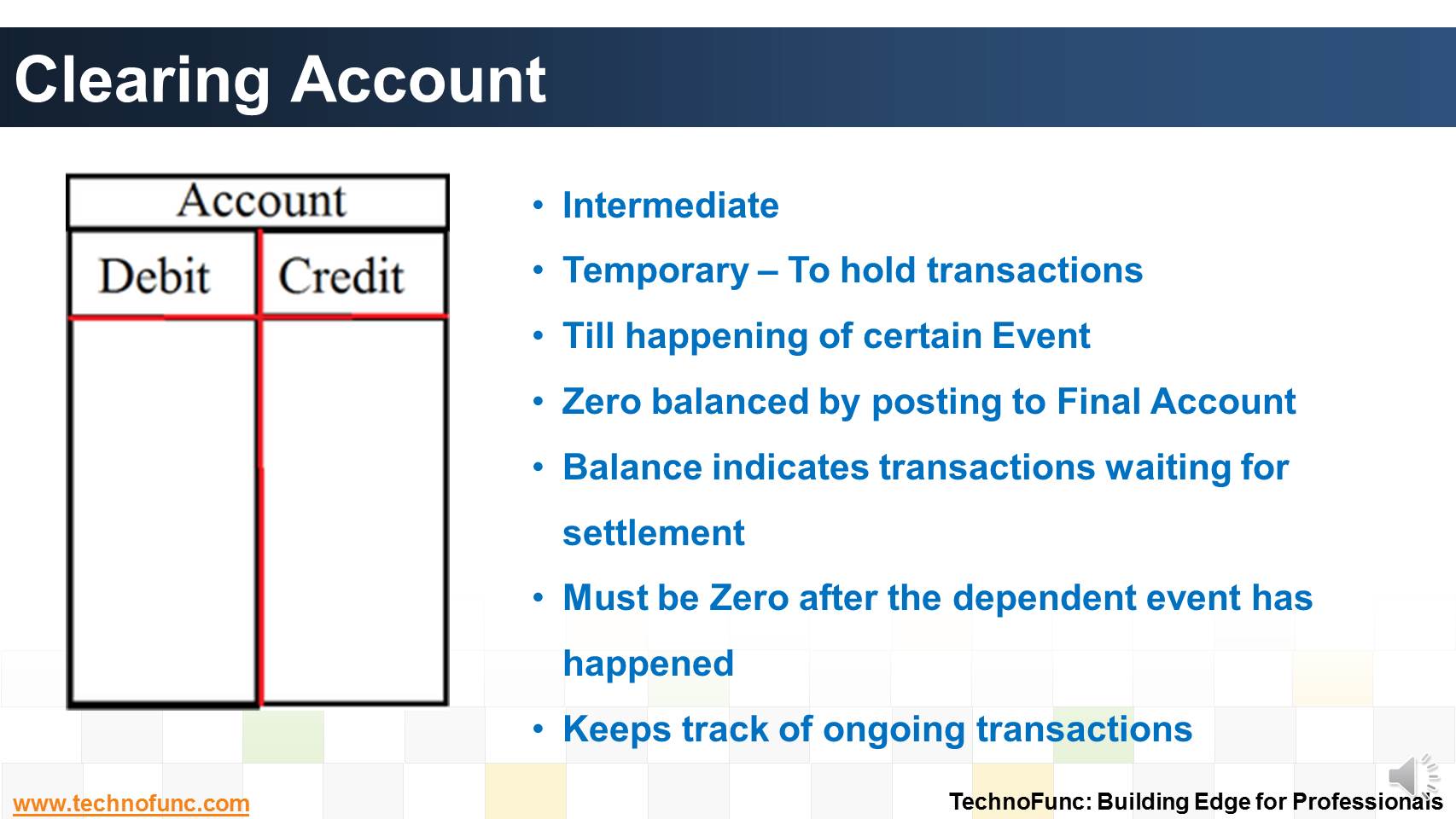

TechnoFunc Clearing Account

A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management. Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets.

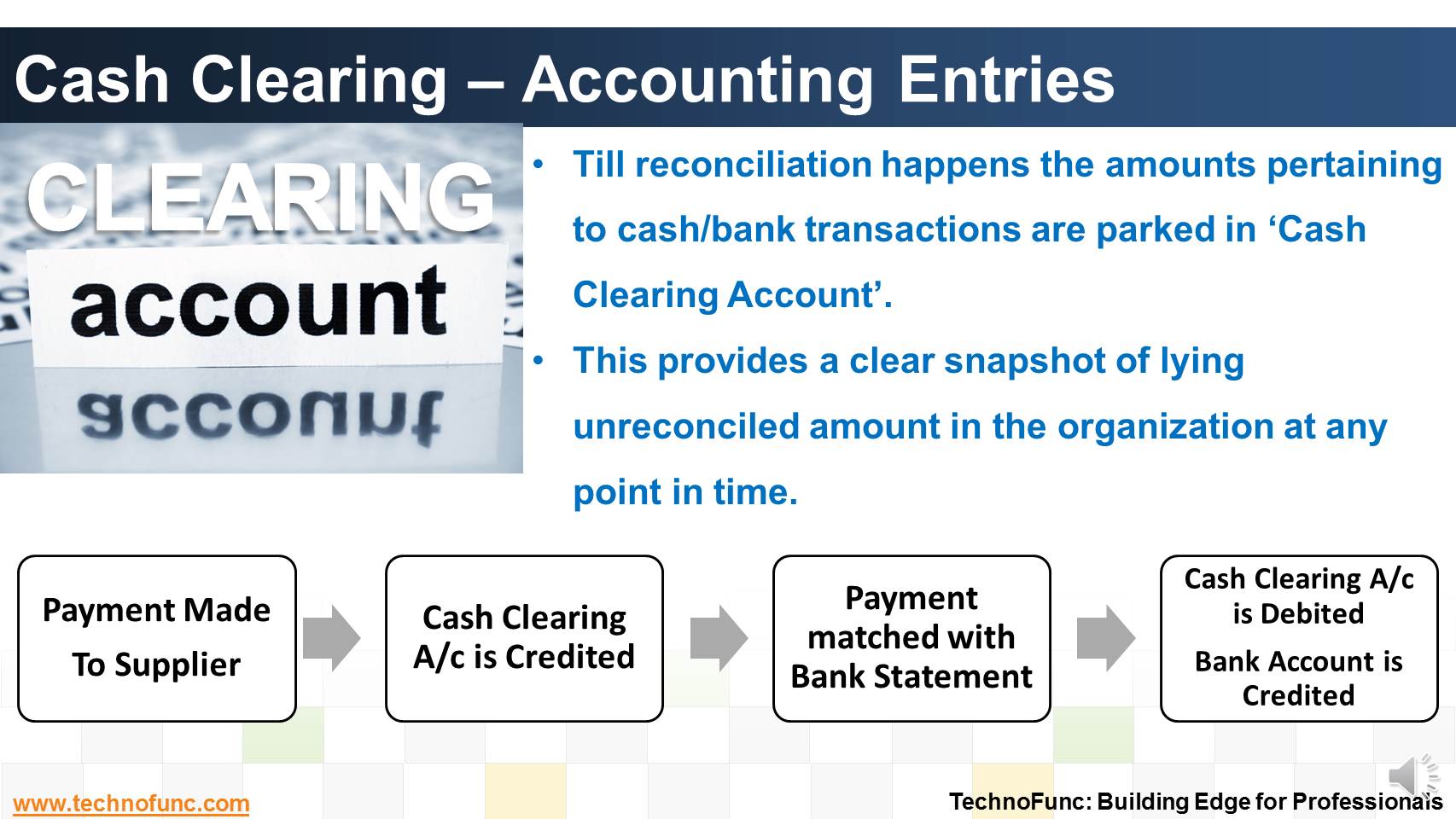

TechnoFunc Cash Clearing Accounting Entries

A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately. Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management.

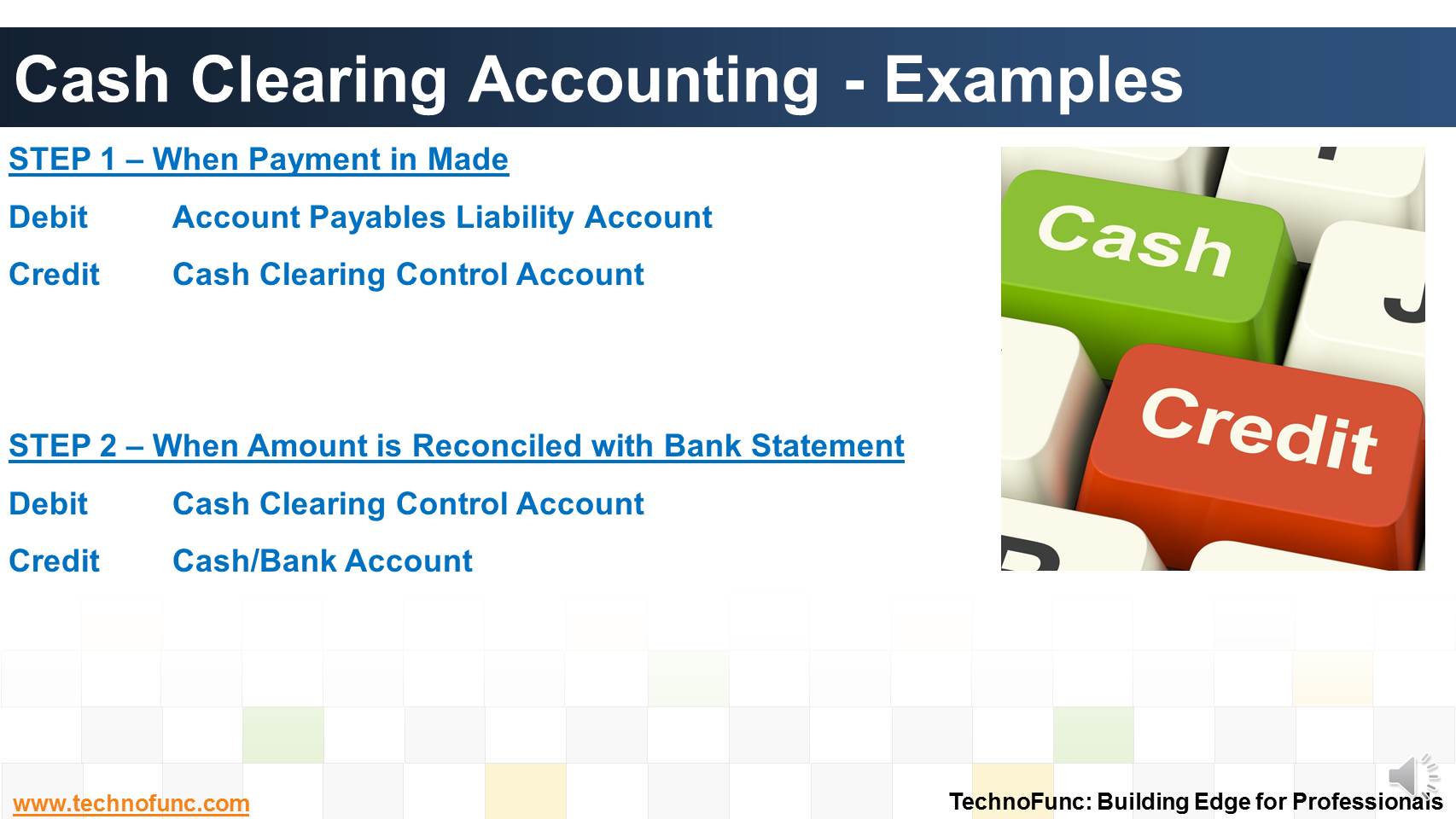

TechnoFunc Cash Clearing Accounting Entries

A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately. Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management.

What is Clearing Account on Balance Sheet Meaning & Definition Emagia

A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management. Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets.

Clearing Accounts Asset, Liability, and Payroll Accounts

Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management. A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately.

Expert Advice on How to Make a Balance Sheet for Accounting

Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management. A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately.

How Can I Reconcile Transactions Using a Clearing Account? iClassPro

Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management.

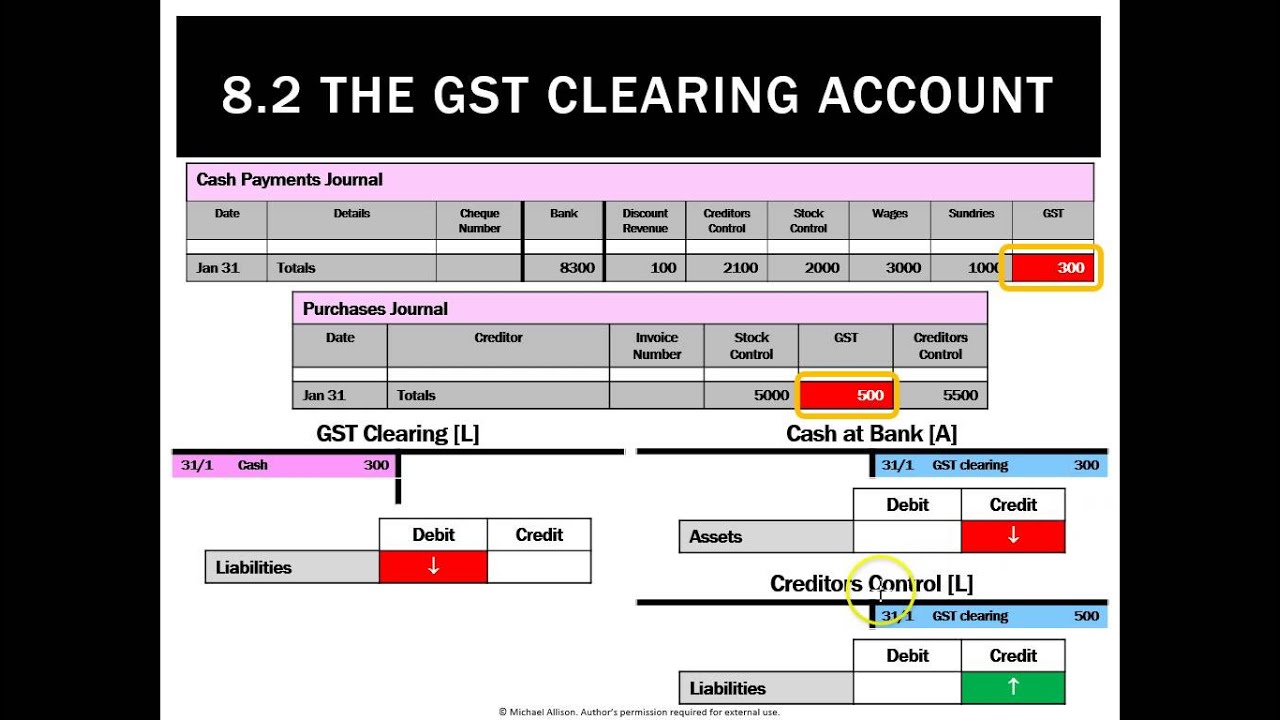

8.2 The GST Clearing account YouTube

Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. A clearing account on a balance sheet is a temporary account that holds transactions until they can be accurately. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management.

A Clearing Account On A Balance Sheet Is A Temporary Account That Holds Transactions Until They Can Be Accurately.

Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. Learn about clearing accounts, their types, setup, uses, and how to reconcile them for effective financial management.