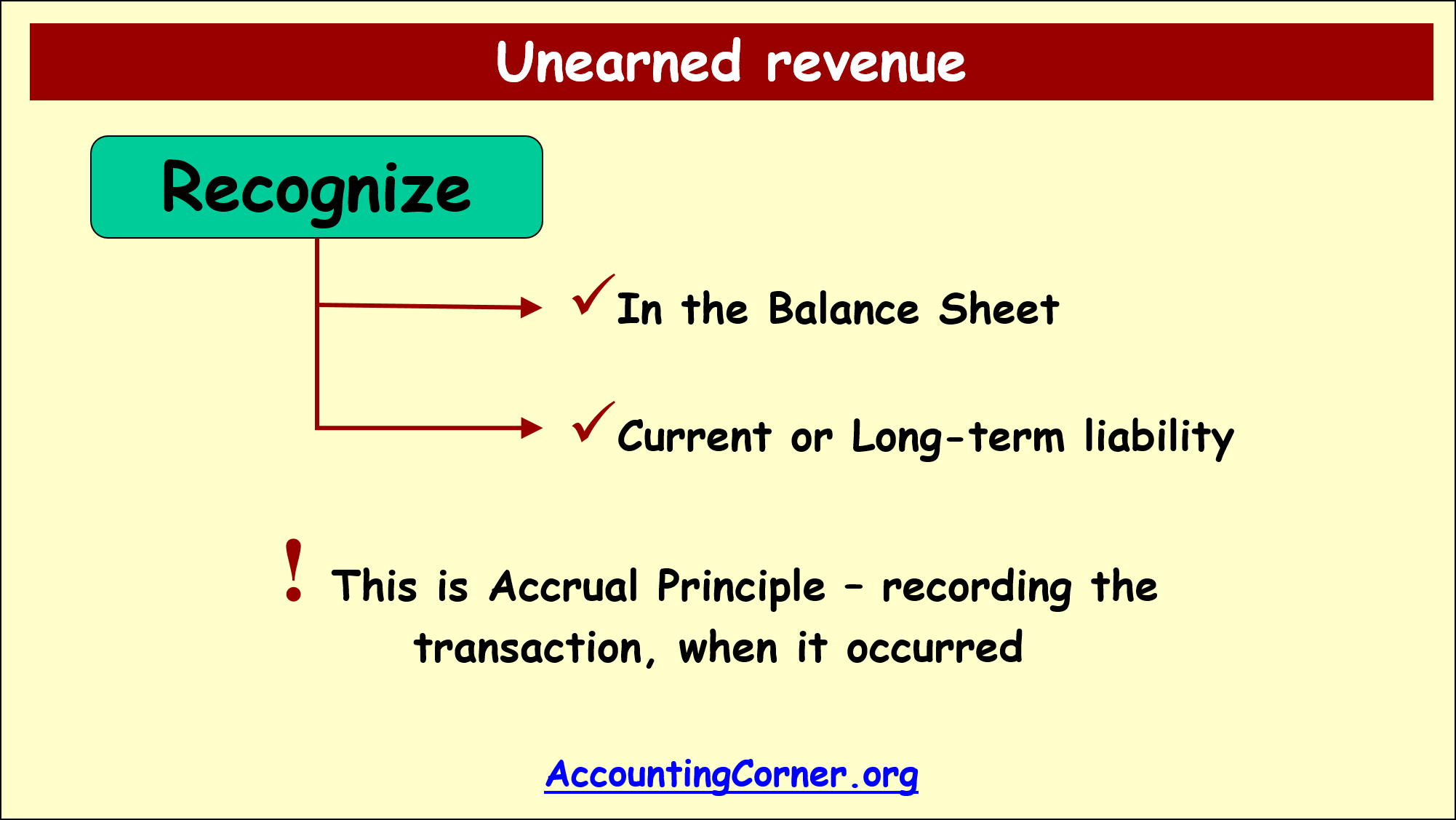

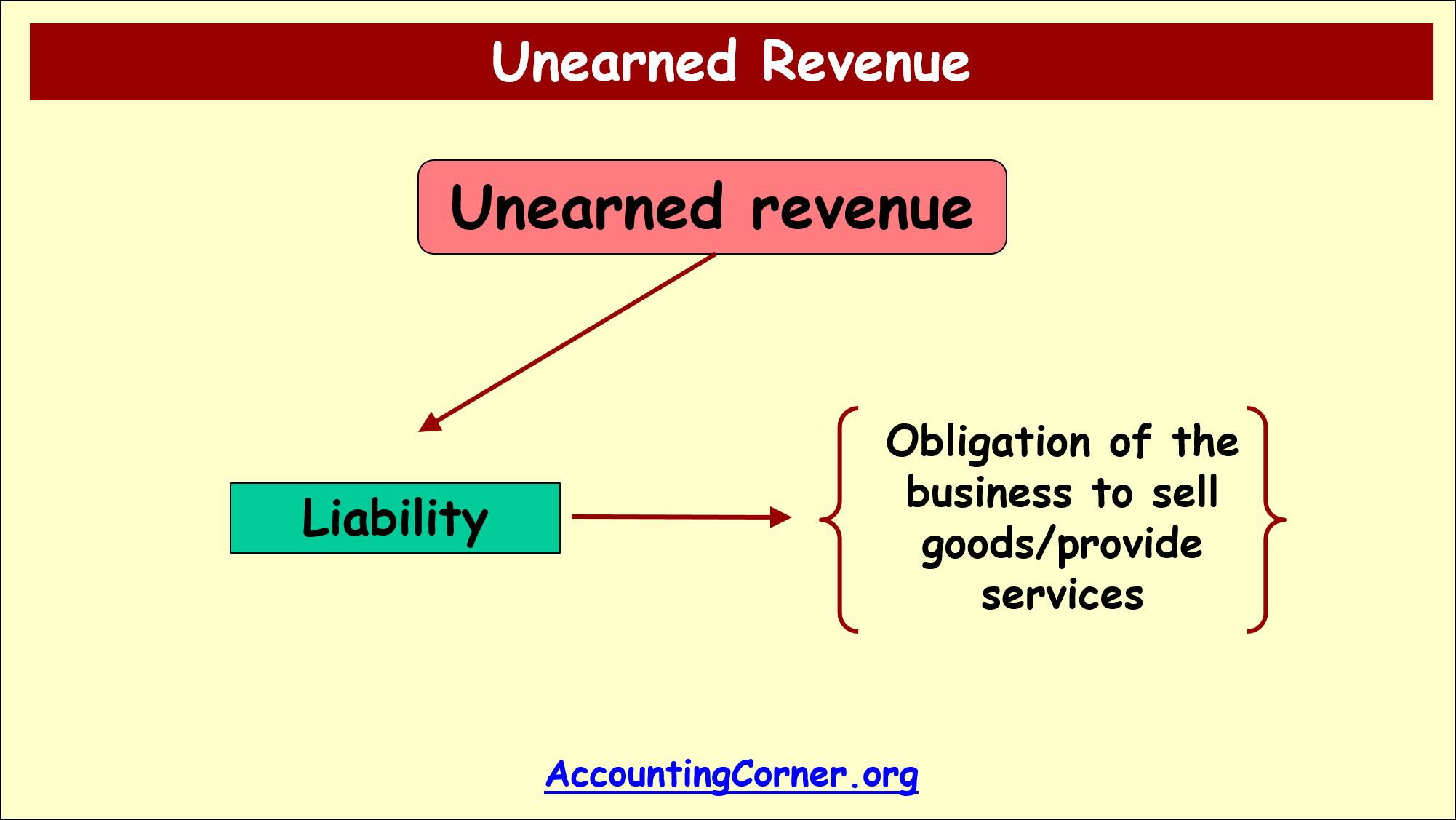

Does Unearned Revenue Go On The Balance Sheet - It is classified as a liability because the company. Unearned revenue is reported on the balance sheet, not the income statement.

It is classified as a liability because the company. Unearned revenue is reported on the balance sheet, not the income statement.

It is classified as a liability because the company. Unearned revenue is reported on the balance sheet, not the income statement.

Is unearned revenue a revenue? Leia aqui What is unearned revenue

Unearned revenue is reported on the balance sheet, not the income statement. It is classified as a liability because the company.

What Is Unearned Revenue? A Definition and Examples for Small Businesses

Unearned revenue is reported on the balance sheet, not the income statement. It is classified as a liability because the company.

Unearned Revenue Definition, How To Record, Example

Unearned revenue is reported on the balance sheet, not the income statement. It is classified as a liability because the company.

Unearned Revenue Accounting Corner

Unearned revenue is reported on the balance sheet, not the income statement. It is classified as a liability because the company.

What is Unearned Revenue? QuickBooks Canada Blog

Unearned revenue is reported on the balance sheet, not the income statement. It is classified as a liability because the company.

What is Unearned Revenue? A Complete Guide Pareto Labs

Unearned revenue is reported on the balance sheet, not the income statement. It is classified as a liability because the company.

Unearned Revenue Accounting Corner

Unearned revenue is reported on the balance sheet, not the income statement. It is classified as a liability because the company.

Unearned Revenue Journal Entry LizethkruwSmith

Unearned revenue is reported on the balance sheet, not the income statement. It is classified as a liability because the company.

Unearned Revenue Definition

Unearned revenue is reported on the balance sheet, not the income statement. It is classified as a liability because the company.

Unearned Revenue Is Reported On The Balance Sheet, Not The Income Statement.

It is classified as a liability because the company.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)