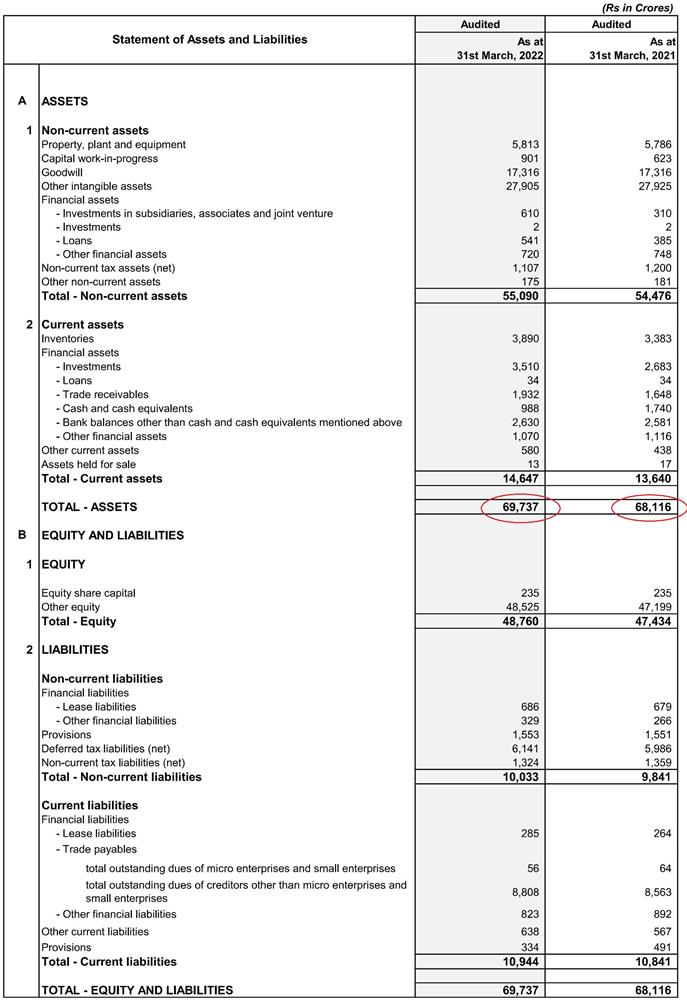

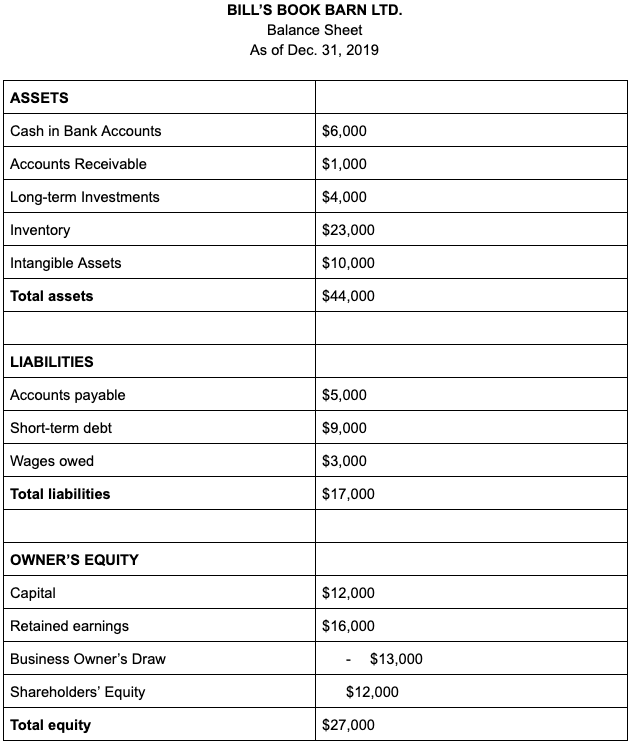

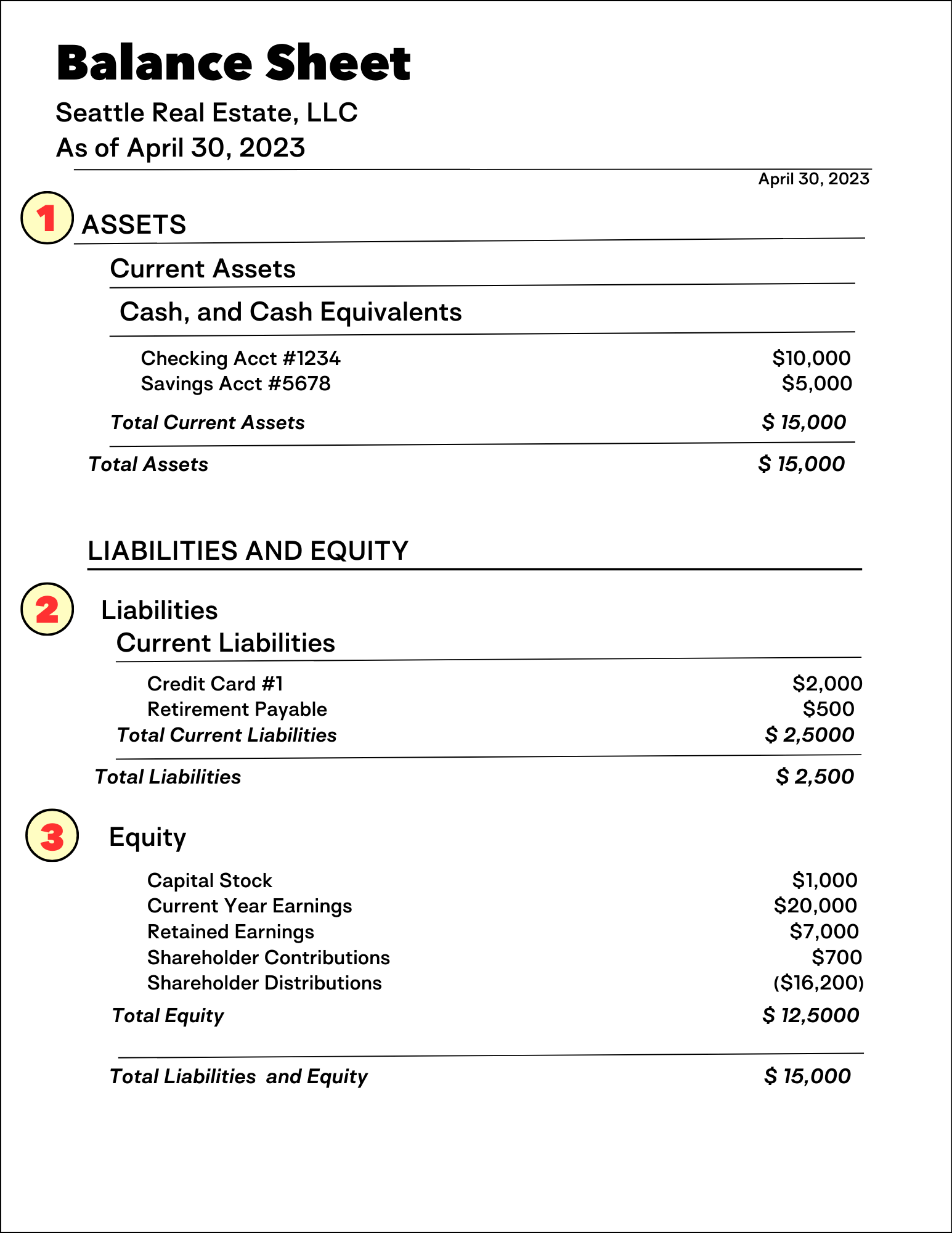

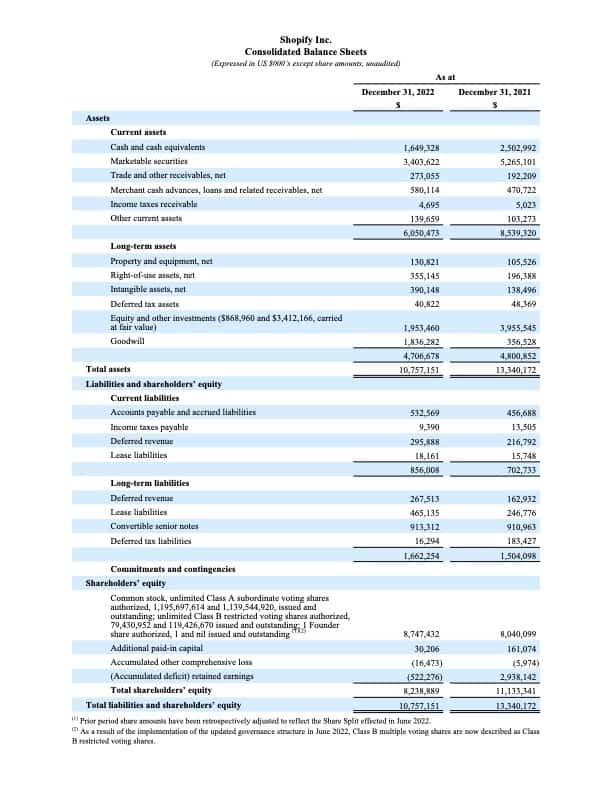

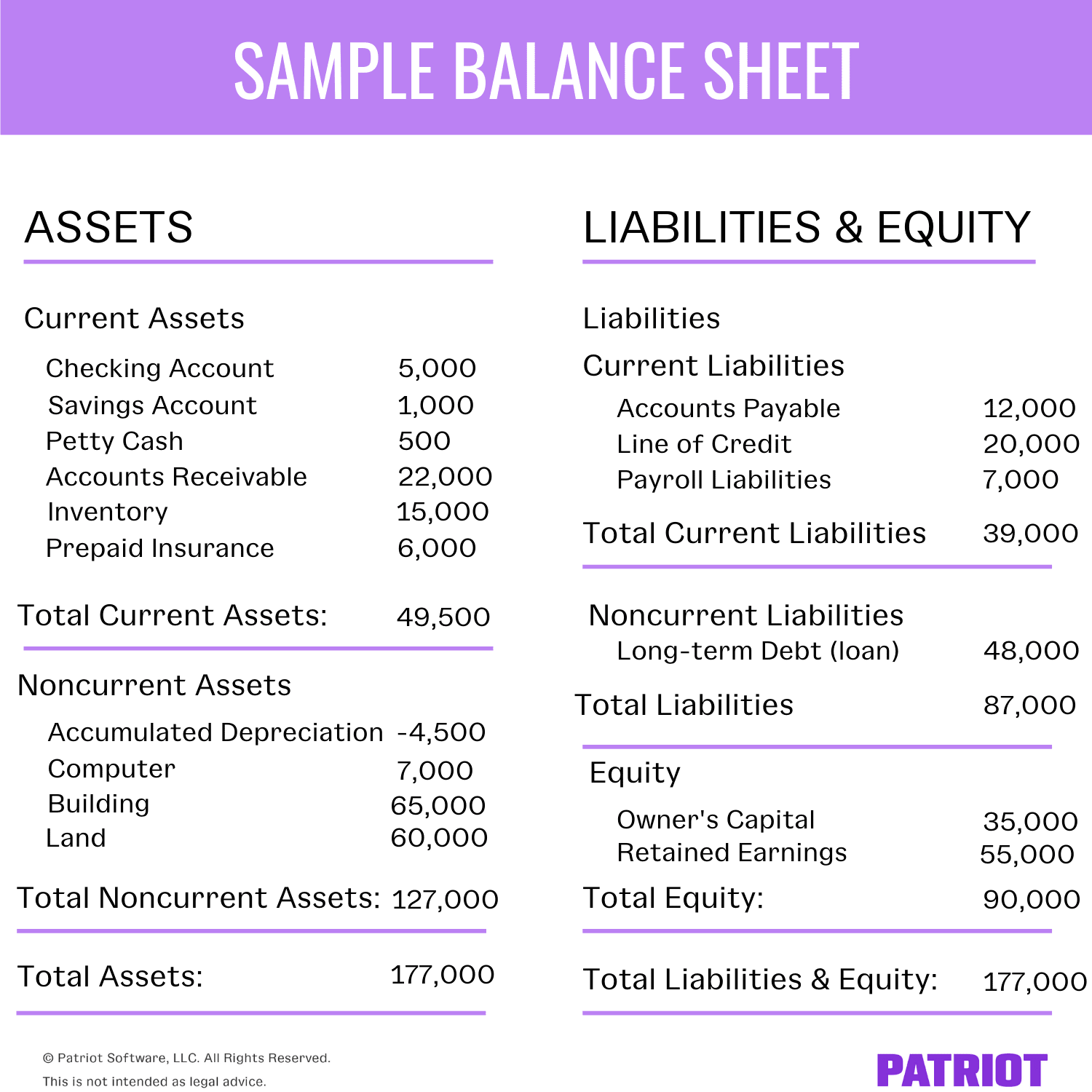

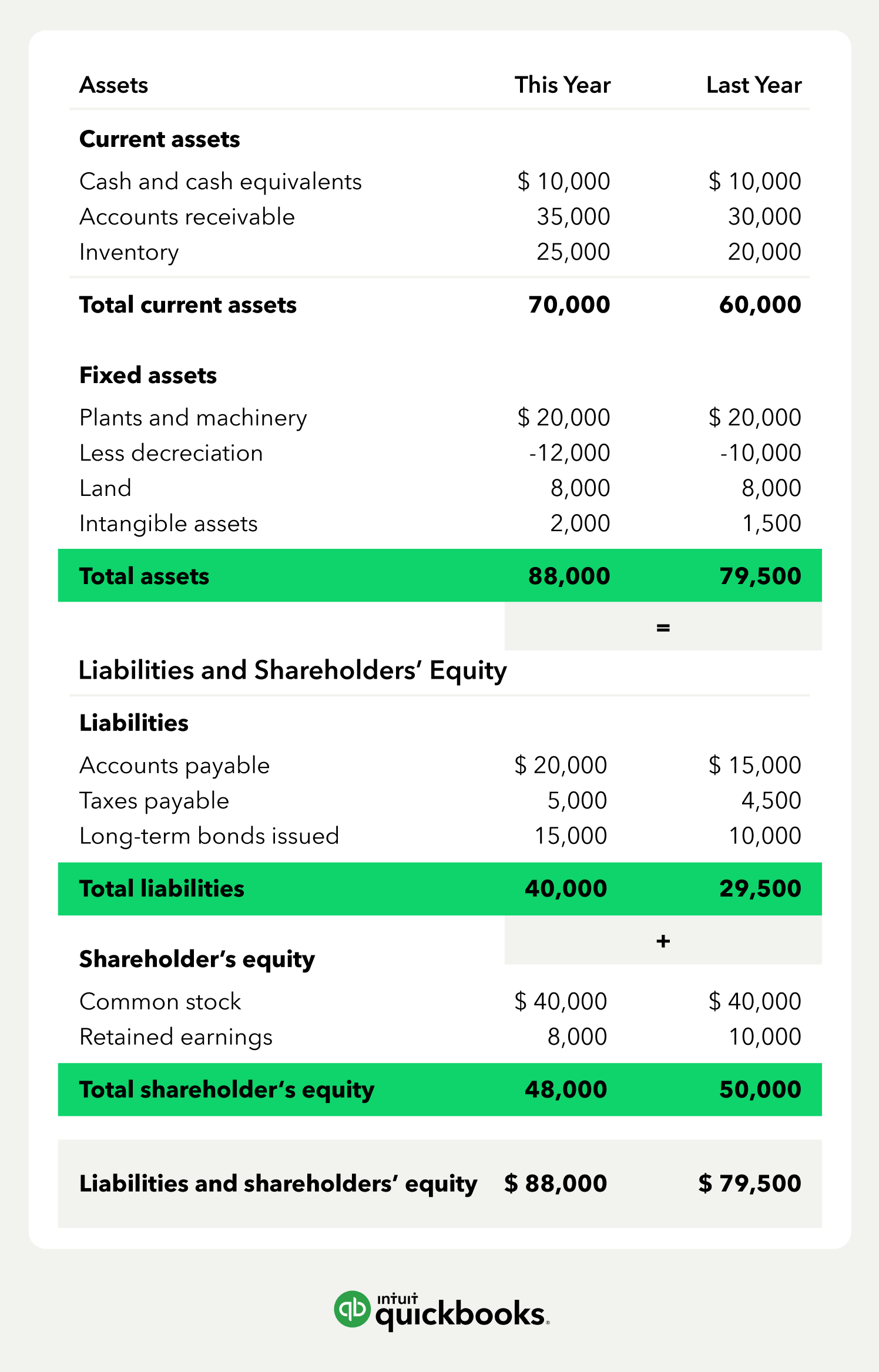

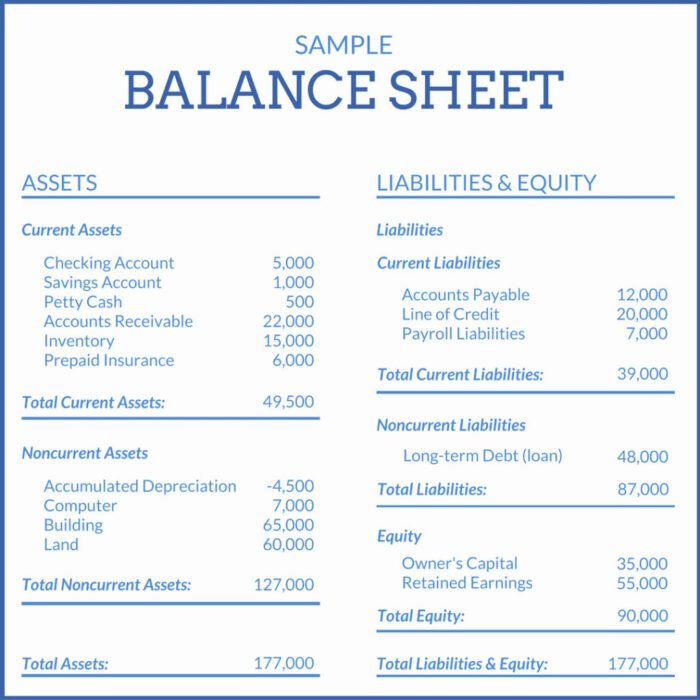

How To Read A Balance Sheet Of A Company - It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. Reading a balance sheet is important in determining the financial health of a company. Balance sheets serve two very different. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. This page explains a balance sheet, why it’s essential, and how to read and create one. It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. How to read a balance sheet? The balance sheet is a key financial statement that provides a snapshot of a company's finances. The balance sheet is split into three sections: A balance sheet provides a summary of a business at a given point in time.

It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. A balance sheet provides a summary of a business at a given point in time. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. The balance sheet is a key financial statement that provides a snapshot of a company's finances. It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. How to read a balance sheet? The balance sheet, also known as the statement of financial position, is one of the three key financial statements. The balance sheet is split into three sections: This page explains a balance sheet, why it’s essential, and how to read and create one. Balance sheets serve two very different.

A balance sheet provides a summary of a business at a given point in time. This page explains a balance sheet, why it’s essential, and how to read and create one. Balance sheets serve two very different. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. Reading a balance sheet is important in determining the financial health of a company. The balance sheet is split into three sections: The balance sheet is a key financial statement that provides a snapshot of a company's finances. How to read a balance sheet? It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. The balance sheet, also known as the statement of financial position, is one of the three key financial statements.

How to Read a Balance Sheet

The balance sheet is split into three sections: A balance sheet provides a summary of a business at a given point in time. How to read a balance sheet? It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. The balance sheet is.

How to Read a Balance Sheet Bench Accounting

It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. This page explains a balance sheet, why it’s essential,.

How to Read a Balance Sheet?

The balance sheet is a key financial statement that provides a snapshot of a company's finances. It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. Reading a balance sheet is important in determining the financial health of a company. How to read a balance sheet?.

How to Read a Balance Sheet The Motley Fool Canada

How to read a balance sheet? The balance sheet is a key financial statement that provides a snapshot of a company's finances. It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. Reading a balance sheet is important in determining the financial health.

How to read Financial Statements of a Company? Trade Brains

The balance sheet, also known as the statement of financial position, is one of the three key financial statements. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. How to read a balance sheet? This page explains a balance sheet, why it’s essential, and how to read and create one. The balance sheet.

How to Read & Understand a Balance Sheet HBS Online

It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. The balance sheet is split into three sections: A balance sheet provides a summary of a business at a given point in time. It’s a snapshot of a company’s financial position, as broken.

How To Read And Understand A Balance Sheet Business Explained Lights

The balance sheet, also known as the statement of financial position, is one of the three key financial statements. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. Reading a balance sheet is important in determining the financial health of a company. The balance sheet is a key financial statement that provides a.

How to Read & Prepare a Balance Sheet QuickBooks

This page explains a balance sheet, why it’s essential, and how to read and create one. How to read a balance sheet? It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. Reading a balance sheet is important in determining the financial health of a company. A balance sheet provides a summary of a.

How read your balance sheet and actions to take

Reading a balance sheet is important in determining the financial health of a company. It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. A balance sheet provides a summary of a business at a given point in time. Balance sheets serve two very different. The.

How to read and understand financial statements

The balance sheet is split into three sections: It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. Balance sheets serve two very different. This page explains a balance sheet, why it’s essential, and how to read and create one. The balance sheet, also known as.

The Balance Sheet Is A Key Financial Statement That Provides A Snapshot Of A Company's Finances.

Reading a balance sheet is important in determining the financial health of a company. A balance sheet provides a summary of a business at a given point in time. It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time.

Balance Sheets Serve Two Very Different.

This page explains a balance sheet, why it’s essential, and how to read and create one. The balance sheet is split into three sections: How to read a balance sheet? The balance sheet, also known as the statement of financial position, is one of the three key financial statements.