Sch K-1 Tracking Sheet For Tax Preparers - For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate. Include your share on your tax return if a return is required. Includes key info like tin and income details. Investment and short term rental income are reported differently depending on your participation in a business.

Investment and short term rental income are reported differently depending on your participation in a business. For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate. Include your share on your tax return if a return is required. Includes key info like tin and income details.

Includes key info like tin and income details. For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate. Investment and short term rental income are reported differently depending on your participation in a business. Include your share on your tax return if a return is required.

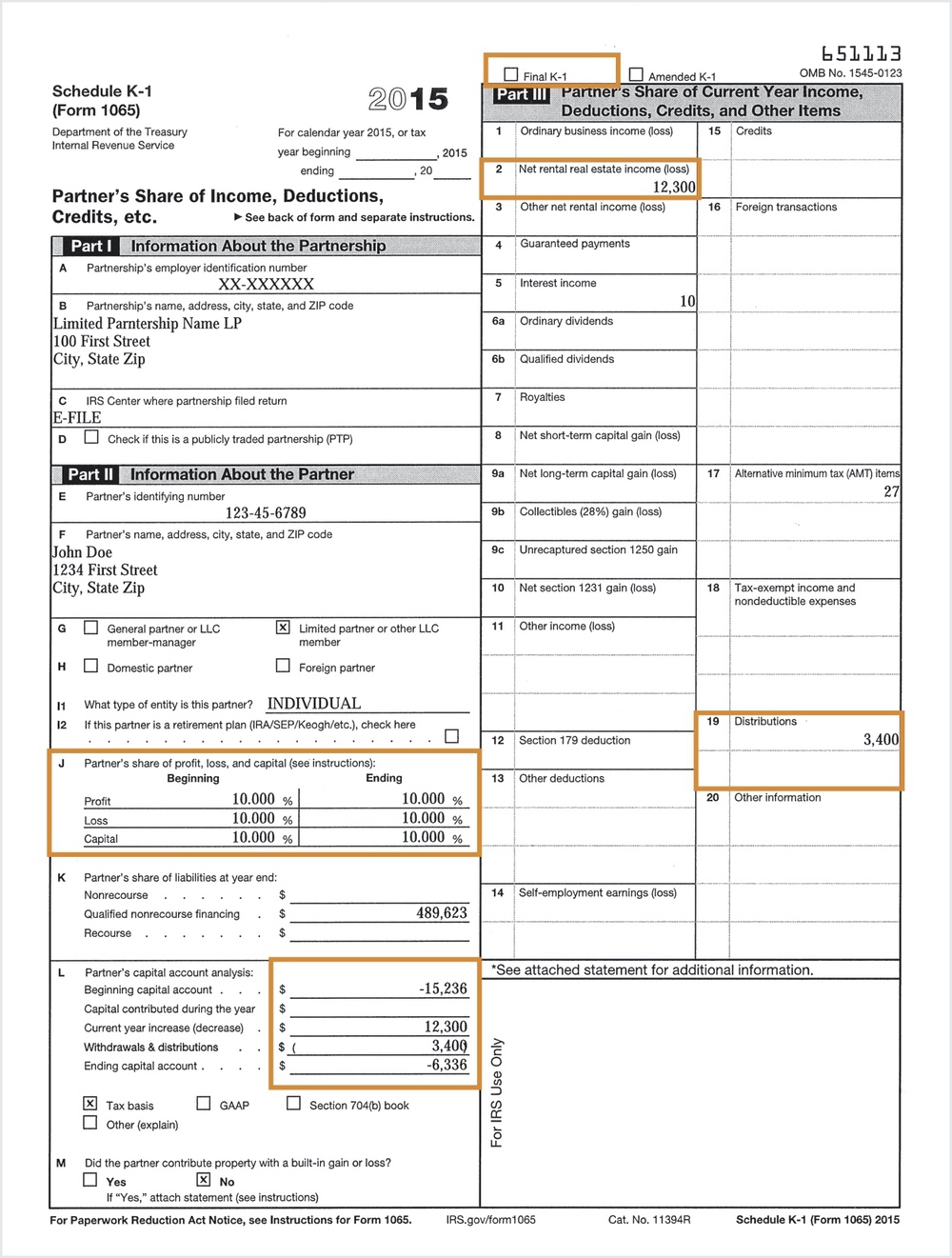

Schedule K1 / 1065 Tax Form Guide LP Equity

Investment and short term rental income are reported differently depending on your participation in a business. Include your share on your tax return if a return is required. For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate. Includes key info like tin and income details.

Sayglossy 100 Pcs 9 x 6.3 Inch Tax Return Envelopes

Includes key info like tin and income details. Investment and short term rental income are reported differently depending on your participation in a business. For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate. Include your share on your tax return if a return is required.

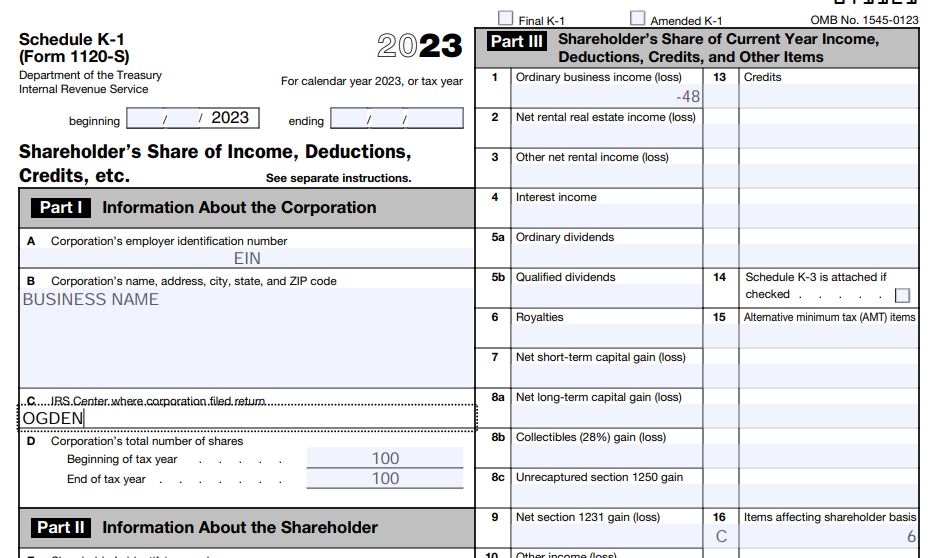

Glen Birnbaum on Twitter "We have our first look at the 2023 DRAFT K1

Include your share on your tax return if a return is required. Includes key info like tin and income details. Investment and short term rental income are reported differently depending on your participation in a business. For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate.

How to fill out Form 1120S and Schedule K1 for 2023 S Corporation

For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate. Investment and short term rental income are reported differently depending on your participation in a business. Includes key info like tin and income details. Include your share on your tax return if a return is required.

Tax Prep Checklist Tracker Printable, Tax Prep 2023, Tax Checklist, Tax

Include your share on your tax return if a return is required. Investment and short term rental income are reported differently depending on your participation in a business. Includes key info like tin and income details. For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate.

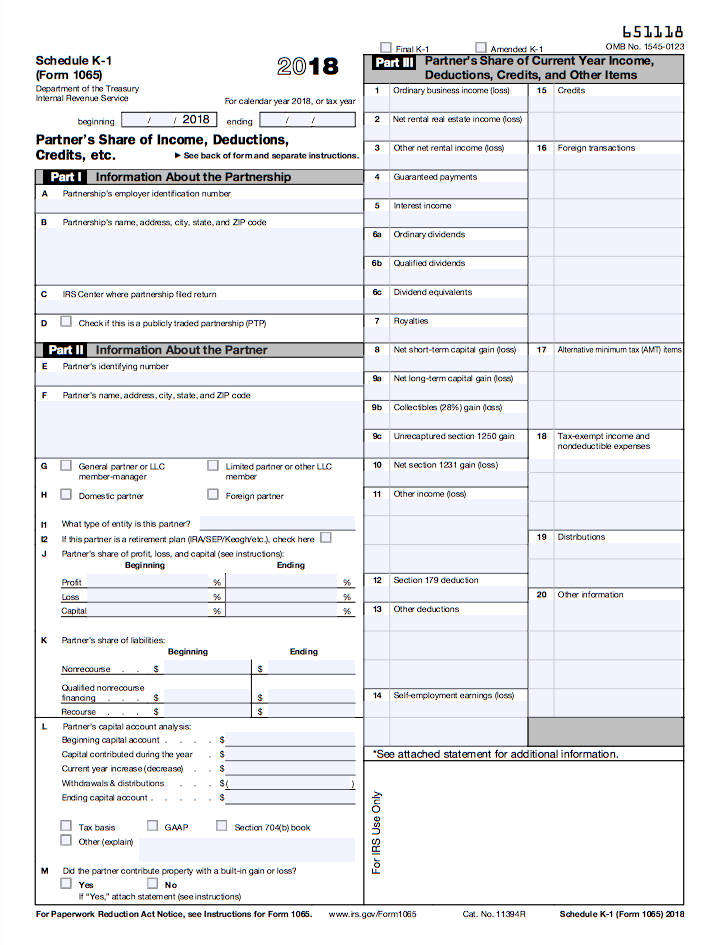

2024 Schedule K1 Instructions sayre lizzie

Include your share on your tax return if a return is required. Includes key info like tin and income details. For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate. Investment and short term rental income are reported differently depending on your participation in a business.

How To Fill Out Form 1041 K1 at Katherine Roosa blog

Investment and short term rental income are reported differently depending on your participation in a business. Includes key info like tin and income details. Include your share on your tax return if a return is required. For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate.

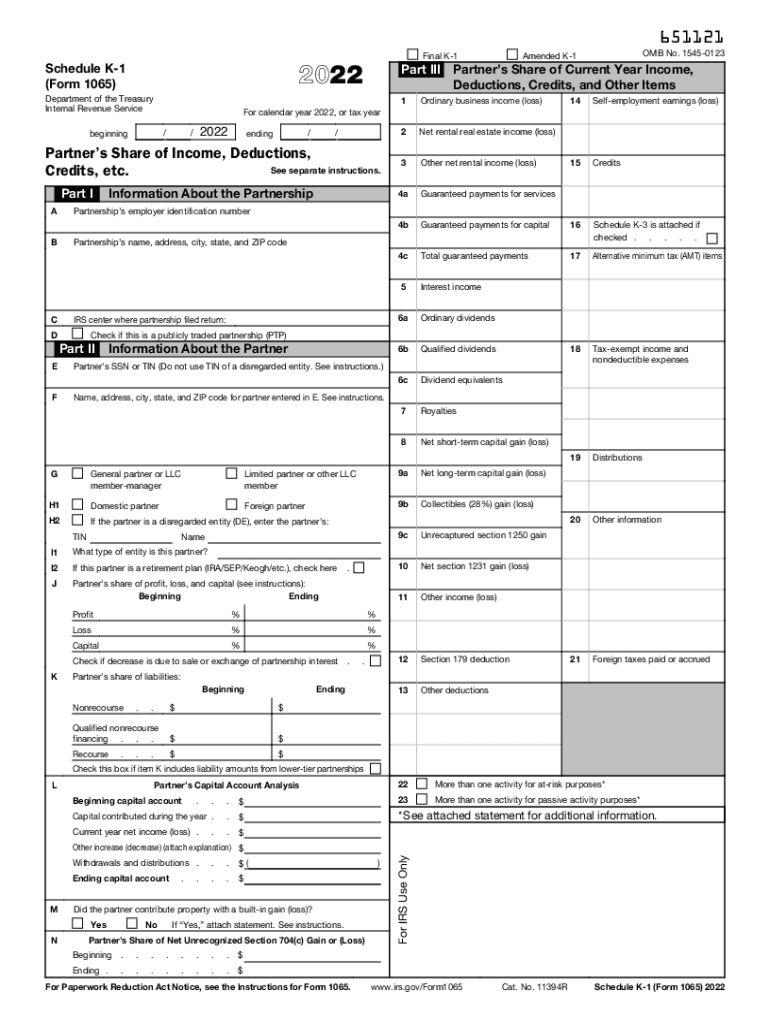

Schedule K1 Form 1120s Instructions 2025 Layla Hannah

Include your share on your tax return if a return is required. Investment and short term rental income are reported differently depending on your participation in a business. Includes key info like tin and income details. For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate.

A Simple Guide to the Schedule K1 Tax Form Bench Accounting

For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate. Investment and short term rental income are reported differently depending on your participation in a business. Includes key info like tin and income details. Include your share on your tax return if a return is required.

Schedule K1 2024 Printable elaine alberta

For tax professionals, including enrolled agents and cpas who work with partnerships, you need to know how to navigate. Include your share on your tax return if a return is required. Includes key info like tin and income details. Investment and short term rental income are reported differently depending on your participation in a business.

For Tax Professionals, Including Enrolled Agents And Cpas Who Work With Partnerships, You Need To Know How To Navigate.

Include your share on your tax return if a return is required. Includes key info like tin and income details. Investment and short term rental income are reported differently depending on your participation in a business.